The ATR indicator is designed to ignore the normal volatility of a stock and thus it can “automatically” find good reversal levels regardless of the value or volatility of the stock selected. ATR with a value of 14 is the default value for Kagi charts and should generate a very usable chart in most cases. If today’s close is higher than the top of the previous block, a new white block is drawn in the next column from the prior high to the new high price.

- On day 3, as price closed at 98, we switch columns and draw a falling line that stretches from 104 to 98.

- As perdifferent intraday trading strategy, traders use different time frames.

- However, notice that price has now reached the immediately preceding horizontal line .

- If the prevailing line is trending higher and if price closes below the high of the prevailing line but fails to move by at least the reversal size, the price action for that period is ignored.

- Kagi charts can be a valuable tool for you as a trader if you want to analyze the markets, identify trends, and make informed trading decisions.

Truth is, Kagi charts reduce noise and isolate the trend, allowing you to view direction more clearly. Thus, Kagi charts are simple and show trends, patterns, and outcomes. The word Kagi means “key” in Japanese and in many ways, the chart itself is viewed as the key to detecting changes in market sentiment. Once gauged, the market sentiment can influence buy and sell decisions, which is the primary use case of technical analysis on charts.

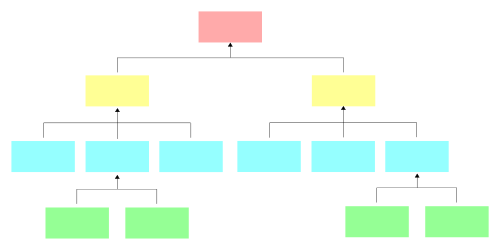

Change in the current trend is indicated by the change in the columns. Technical analysis is made easy with the help of these charts because they represent the price movements in the visual format. Following are different types of charts that are used by the traders and investors to study the price fluctuations of stocks. Observe in the above chart that classical price patterns that are applicable to bar charts and candlestick charts can be applied to Kagi charts as well.

Module 1: Technical Analysis

Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs. What you also need to remember is your risk tolerance and use the right kind of trading platform like Dhan to start trading online.

5 Best TradingView Brokers in May 2023 – Business 2 Community TR

5 Best TradingView Brokers in May 2023.

Posted: Wed, 01 Mar 2023 08:00:00 GMT [source]

kagi charts charts are price charts with thick and thin vertical lines connected by short horizontal lines. It is a type of chart developed by the Japanese in the 1870s that uses a series of vertical lines to illustrate general levels of supply and demand for certain assets. Also, it is very useful for a day trader to manage their risk, which is an important factor for day trading.

Line calculation methods #

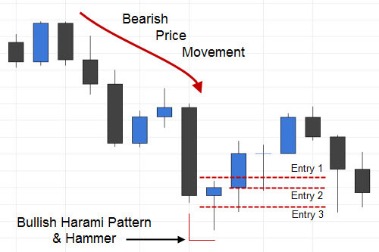

Day traders look for pattern formation in candlestick charts for trade signals and it also helps traders to manage their risk with a clear idea of the right stop-loss and target price. Candlestick chart is also known as a5-minute candlestick chart. Candlestick charts are one of the most popular types ofintraday trading charts. There are four prices in candle open, low, high, and close. For a 1-minute time frame, you can see a 1-minute candle for 5-minute time frame candles are generated for 5 minute time period.

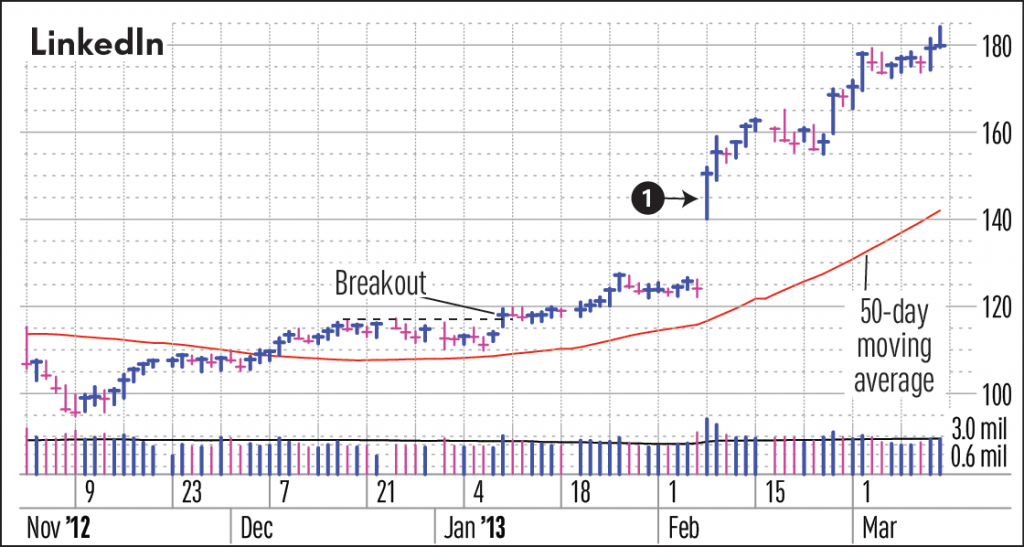

In the above chart, notice that between March and July, price entered a consolidation range. In early August however, price broke above this consolidation range, potentially signalling an up move in the coming days. To trade this breakout, one can enter a long position at the time of the breakout , keeping a stop loss below the low of the breakout Kagi line .

Kagi charts also make it easier to identify support and resistance levels, and they can be used to create automated trading systems via stock trading APIs. Technical trading journey In market, prices and trend are most important factors, and you must have ability to analyze them and to identify them to make profit out of it. Technical analysis study will definitely going to help with that. Trends on charts When you learn technical analysis efficiently then you can see… Types of charts Charts present an arrangement of price over a set timeframe, which can range from minutes to years.

Kagi chart, the first step is to calculate the reversal amount. Reversal amount is the minimum change of price required to make Kagi line move in the reverse direction. As you can clearly see, this chart doesn’t look anything like traditional trading charts.

The thick part of the candlestick chart represents the range between the opening and the closing price. The long thin lines or the candle wicks represent the range of price movement from the bar. All the different intraday trading charts have a time frame. Especially, for day trading 1, 5, 15, and 30- the minute timeframe is suitable. In the time frame of 5-minute, after every 5-minute a new price bar will form and shows the price movements for those 5 minutes.

Interview Focus on stocks in sectors that outperforming major indices & showing strong trend, says… – Moneycontrol

Interview Focus on stocks in sectors that outperforming major indices & showing strong trend, says….

Posted: Mon, 03 Apr 2023 07:00:00 GMT [source]

Hence, we will have a green line that will stretch from 100 to 104. If the prevailing line is trending higher and price closes above the high of the prevailing line, the current trend continues, and the prevailing line extends higher by the amount of the close. This chart is exceptionally beneficial to traders in the trending market.

Construction of Kagi charts

Kagi chart uses a series of vertical lines which depict the movement of price. Kagi charts are believed to have been created around the time that the Japanese stock market began trading in the 1870’s. Kagi charts display a series of connecting vertical lines where the thickness and direction of the lines are dependent on the action of the price value. These charts ignore the passage of time, but can be used to illustrate the forces of supply and demand on a security. The Kagi Chart is known to appear as similar to the swing charts.

The Program introduces Technical Analysis is a trading discipline employed to evaluate investments and identify trading opportunities in price trends and patterns seen on charts. The correct analysis of market directly leads to more profits as technical analysis gives more important insights into the future price movements. Technical Analysis is a world Recognize Gold standard of knowledge widely Recognized by the trading and Investment community.

Candlestick Chart Analysis

The above chart is the daily chart of Bank Nifty with the reversal size being 50 points. There are two moving averages used here, the 30-SMA and the 50-SMA. Bullish MA crossovers have been signalled with a green upward pointing arrow, while bearish MA crossovers have been signalled with a red downward pointing arrow. Observe here that from January 2015 to April 2016, Bank Nifty was trading underneath a falling resistance line, indicating a downtrend in place.

- Truth is, Kagi charts reduce noise and isolate the trend, allowing you to view direction more clearly.

- It consists of columns of X’s and O’s that represent filtered price movements.

- Thus, Kagi charts are simple and show trends, patterns, and outcomes.

- Now that we have a rising line, for the prevailing line to extend, price needs to close above the high of this line, which is 104.

- However, we will talk about each of these aspects using a sample chart, which will make the concepts of a Kagi chart much simpler to understand and interpret.

For instance, if the current line is green and if price closes under the immediately preceding horizontal line, the colour of the line changes from green to red. Similarly, if the current line is red and if price closes above the immediately preceding horizontal line, the colour of the line changes from red to green. The colour of the line changes at the point where the horizontal line is surpassed. It is not necessary that columns change for colour of the line to change. The table below shows the daily closing price for each session.

Means momentum looks deep into the tendency for rising market prices to rise further, and falling prices to keep falling. For example, we already saw that stock performed well in… Top 5 most popular charting softwares review Charting platforms are one of the important infrastructures in traders or investors life. A good charting platforms with flexibility, affordability, and best customization can help traders to achieve its goals. That why I handpicked 5 top Charting platforms for traders and investors. ESignal charting Software Award-winning trading software…

Market Pulse is on mission to empower traders to make more informed trading decisions by giving them all the necessary intelligence, speed and power. “I thought doing technical analysis on mobile was impossible. After using Market Pulse, I do 90% of my analysis on mobile. It’s convenient and fast.” Set strategies & get alerted on signals or simply set a price trigger. Our specially designed professional technical analysis Course can help you to make sense of the right way to analysis Securities, make Discipline and follow a proper money management. This course is marked as Practical approach for world standard technical analysis Certification Like – CMT, CFTe and STA.

They are used to utilize concepts such as support and resistance and other patterns when viewing P&F charts. Kagi charts are used for tracking price movements and to make decisions on purchasing stocks. They are simple line charts that change direction when prices move by a reuired amount. It consists of a continuous line that changes directions and switches from thin to bold. The direction of the line changes when the price of the security changes beyond a predefined amount.

Hence, they can easily find out the supporting or the resisting levels. No inclusion of time factor providing the audience simple and straight forward information. If the prevailing line is trending higher , all that is needed for the prevailing line to extend further is a close that is above the high of the prevailing line. The UsedYValue attribute, for a Series with multiple YValues, defines a zero based index of which Y values to use.

It is not concerned with the intrinsic value of the stocks and hence it will not indicate the cost of a stock. What it can reveal is whether the investments can turn into gain or loss by solving the problem of timing.For this analysis, different types of charts are used showing the price over time. Based on the past Chart statistics, forecast of future price movements can be easily done.

By going through this line, one can easily know the present behavior of that particular stock. Closing prices is considered as the most powerful and important information that reveals the end of the game and informs about the winner. As price has risen and the prevailing line is a rising line, we extend the line further from 120 to 121. So, at the end of day 26, we continue to have a rising, red line. However, notice that price has now reached the immediately preceding horizontal line . If in the coming days, price closes above 121, the colour of the line will change from red to green.

When the closing price is higher or lower than the two lines already there, a reversal procedure takes place by introducing a new white or black block. According to Meta stock Help, “To draw line break blocks, today’s close is compared to the high and low of the previous block. A block is drawn only when today’s close exceeds the high or low of the previous block. As shown above in this chapter, you can successfully trade breakouts from support and resistance levels using Kagi charts. In fact, you can also deploy other tools such as technical indicators, price patterns etc.

The next chart that we would be talking about is the Kagi chart. In terms of appearance, this chart looks a little different than the Renko and the line break chart that we discussed in the earlier chapters. This is because unlike a Renko or a line break chart, a Kagi chart is represented by lines .

Contents:

The hotel provides many on-site amenities including 10 function rooms and a restaurant with a bar section. The exchange does not charge anything for trading CAD. However, you will have to pay 1% for using BTC, LTC, or ETH. This is a very low sum, but you have to remember that something will be taken by the payment systems too so that there would be no surprises once the funds are sent.

It is completely free for all customers who work with the service. This makes the usage of the exchange much easier for everyone. To compete with other similar services, Quebex provides lower fees and always tries to improve the quality of its service. The simplicity of the website proves the ambition of the exchange, but this will be discussed a bit later. The company is relatively new as it was founded in 2016.

Keep your documents ready, you might be asked to show your passport. This step makes sure that no frauds enter the exchange and minimizes risks. To ensure the safety of each customer, the exchange has created a verification process that must be completed by every registered client. Overall, Quebex électrique is your trusted local electrician for all of your residential electrical needs.

Fees at Quebex

Prices were available within the past 7 days and start at CA $363 for one-way flights and CA $762 for round trip, for the period specified. Although there are only three coins, these are the most popular ones that most traders use. It is likely for the service to expand this list in the near future depending on how its earnings grow. Just came back & it was just awesome for the adults & kids. We also specialize in basement renovations, offering heated floors, LED lighting options, and many heating options to fit your decor and mood.

- Thank you for having such a welcoming place for people travelling with children.

- Our team will coordinate with Hydro Quebec to ensure that the generator is installed safely and efficiently.

- The pool is fun, the splash pad is great, the dry slide is awesome!

- The main reason is that it is not very popular and works with a relatively small number of customers.

Thank you for having such a welcoming place for people travelling with children. https://forex-review.net/ Electrique specializes in installing residential and commercial standby generators. We understand the importance of having a reliable backup power source during unexpected outages, which is why we offer comprehensive solutions for our clients.

Save an average of 15% on thousands of hotels when you’re signed in

Our team will coordinate with Hydro Quebec to ensure that the generator is installed safely and efficiently. Trust us to provide high-quality workmanship and excellent customer service to ensure that your generator installation is done right the first time. After that 7 days, you will be able to withdraw up to $950 of the crypto currency each 24 hours (determined by the market rate at the time of withdrawal). You will be required to hold any crypto currency you buy in your account for 7 days before you can withdraw it.

It is one of the largest in the world and it is trusted by many financial companies. Never in a million years would I have thought a hotel could have so many entertaining things going on 70% of the time in a 24 hours period. Before you can make a trade, you have to have a registered and fully verified account.

Trade your Litecoin for Bitcoin

Contact us today for a free quote and to learn more about how we can help with your electrical needs. At Quebex électrique, we understand the importance of safety and efficiency when it comes to residential electrical work. That’s why we focus on doing each job right the first time, ensuring that all work is done in compliance with local codes and regulations. New users whose identity cannot be verified can help reduce the risk by volunteering to have a 7-day hold placed on their purchases. Our 3-year old son spent 2 1/2 hours on the giant Titanic inflatable slide located just outside of our patio door! The pool is fun, the splash pad is great, the dry slide is awesome!

To request an alternate format of a publication, complete the Government of Canada Publications email form. Use the form’s “question or comment” field to specify the requested publication. People also use other methods, but they are not so popular as the listed above.

If the exchange is satisfied by your credit history, it will let you purchase up to $950 in BTC per day. Outstanding hats off to the staff, they’re awesome. I recommend this quebex place to anyone who wants to stay at a class act hotel with family. Rated 4-star, L’Hôtel Québec is a premiere destination for families and enthusiastic travellers.

Please initiate a chat with staff or submit a help request through the Contact Us page to continue verification. The help our readers quickly estimate whether the service will be a good choice for them, we have prepared a list of positive and negative sides of the exchange. This is a service that is a consumer credit reporting.

Cheap flights from Québec (YQB) to Albany (ALB)

Quebex électrique is a residential electrical company specializing in high-quality electrical services for homeowners in the local area. Our team of skilled electricians is dedicated to delivering quality workmanship and exceptional customer service. We take pride in our work and are committed to providing personalized, attentive service to each of our clients. Second, clients are asked to join a live video chat to confirm their identity.

What can you trade with Quebex?

It is a Canadian cryptocurrency exchange that is based in Montreal, Quebec. The service is registered by local authorities and follows all the financial rules and laws. Although you can initiate trades, many users may be hesitant to accept CAD from you, and you currently have a trade open where verification was requested. Accepting CAD poses a risk to sellers because fraudulent eTransfers could be reversed, but neither Quebex nor the seller can have crypto currency payments reversed.

There are not many opinions about the service on the Internet. The main reason is that it is not very popular and works with a relatively small number of customers. However, on several trading forums, there were people who mentioned that they have worked with this exchange. We asked one of them to leave his opinion so that we could post it here. Quebex provides cryptocurrency wallets for each of the coins it works with.

A manual system typically means a trader is analyzing technical indicators and interpreting that data into a buy or sell decision. An automated trading analysis means that the trader is “teaching” the software to look for certain how to read forex charts signals and interpret them into executing buy or sell decisions. Where automated analysis could have an advantage over its manual counterpart is that it is intended to take the behavioral economics out of trading decisions.

The US dollar is typically seen by investors as a safe-haven asset in times of turmoil, because it retains value rather than plunging. US debt default fears are heating up as a June 1 deadline to lift the $31 trillion ceiling draws closer – and that’s helped the lift greenback over the past two weeks. When constructing a Kagi chart, the principle of signal accumulation is used, when a reversal signal appears and then is outbid. Upward tick appears when a deal between a seller and a buyer was conducted at a higher price than the one before. The number of points the price has to move in order for a column of Xs to become a column of Os, or vice versa. Construction rules, identification of major signals, and the specific features of trading with the Heikin-Ashi chart are here.

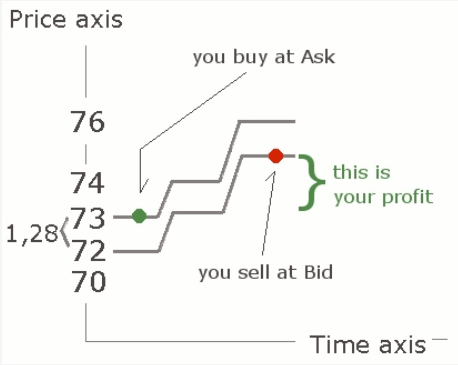

Exchange Rate Pricing – Pips

The first thing to understand is that forex charts are made up of two axes – the x-axis and the y-axis. The x-axis represents time, while the y-axis represents the price of the currency pair. The price is plotted on the y-axis as a series of bars or candlesticks, and each bar or candlestick represents a specific time period, such as one minute, five minutes, or one hour. Many traders find candlestick charts the most visually appealing when viewing live forex charts. They are also very popular as they provide a variety of price action patterns used by traders all over the world which we discuss in more detail in the next section.

Shorter time frames, such as one minute or five minutes, are useful for day traders who want to make quick trades based on short-term price movements. Longer time frames, such as one day or one week, are useful for swing traders who want to hold positions for several days or weeks. The most common type of forex chart is the candlestick chart, which is used by most traders. Candlestick charts provide more information than a simple line chart, as they show the opening, closing, high, and low prices for each time period.

What does a price chart represent?

The purpose of this article is to get you started on your path to knowing and using charts to improve your trade. Take note, throughout our lessons, you will see the word “bar” in reference to a single https://investmentsanalysis.info/ piece of data on a chart. Bars may increase or decrease in size from one bar to the next, or over a range of bars. The line chart also shows trends the best, which is simply the slope of the line.

The line in the chart changes its thickness depending on high the price of an instrument behaves. It is the variable thickness of lines in charts of this type that is the signal for traders to enter a trade. This chart type is basically a technical tool, as it combines major principles of EMA technical analysis indicator. Kagi chart has a basic parameter of the trend reversal level that is, by default, 4% of the previous price movement. To get this information, you should switch to a shorter timeframe of the chart. Nowadays, the most popular way of display is Chinese style, where a rising candlestick is green and a falling one is red.

How to Read the Current Price and Date on Forex Charts

The Average Directional Index (ADX) is a trend strength indicator that measures the strength of a currency pair’s trend over a given period of time. The ADX can help traders identify strong trends and can be a good indicator of trend reversals. Moving averages are trend-following indicators that smooth out price movements over a given period of time. There are several different types of moving averages, including simple moving averages and exponential moving averages.

There are usually different approaches to representing the information on the horizontal or x-axis. Most platforms utilise a linear or arithmetic model that represents time in equal intervals (price bars are printed after a specified amount of time has elapsed). Tick charts print the price based on a certain number of transactions that have been performed in the market. For instance, a 1000 tick chart will print the price after every 1000 transactions. A volume chart basically reflects the volume behind any price level of an underlying asset. This is very important in gauging the buying or selling interest elicited by market participants at any particular price point.

What is the Data on the Trading Chart?

They do represent the highs and low of the trading period as well as the open and closing price. The open and the close price are represented by a horizontal shorter line. The open price is the ‘dash’ that is located on the left side of the vertical bar and conversely the close price indicated by a similar horizontal line, to the right side of the bar. The opposite is true and the decreased value of the stock is indicated in red. A line chart connects the closing prices of the timeframe you are viewing. So, when viewing a daily chart the line connects the closing price of each trading day.

- It was created in the USA, so it is quite popular in Western countries.

- Identifying patterns from candlestick charts – such as a bearish harami or bullish engulfing – can help traders identify possible turning points and the beginning, or end of, market cycles.

- The green arrow points to the menu for switching the type of scales (percentage and logarithmic), as well as the current time and time zone.

- The blue box marks the time scale that shows the EUR value past performance.

- As it doesn’t display highs and lows, these are clear horizontal lines; when the price breaks them out, it is a signal to enter a trade.

- The fluctuation in bar size is because of the way each bar is constructed.

Contents:

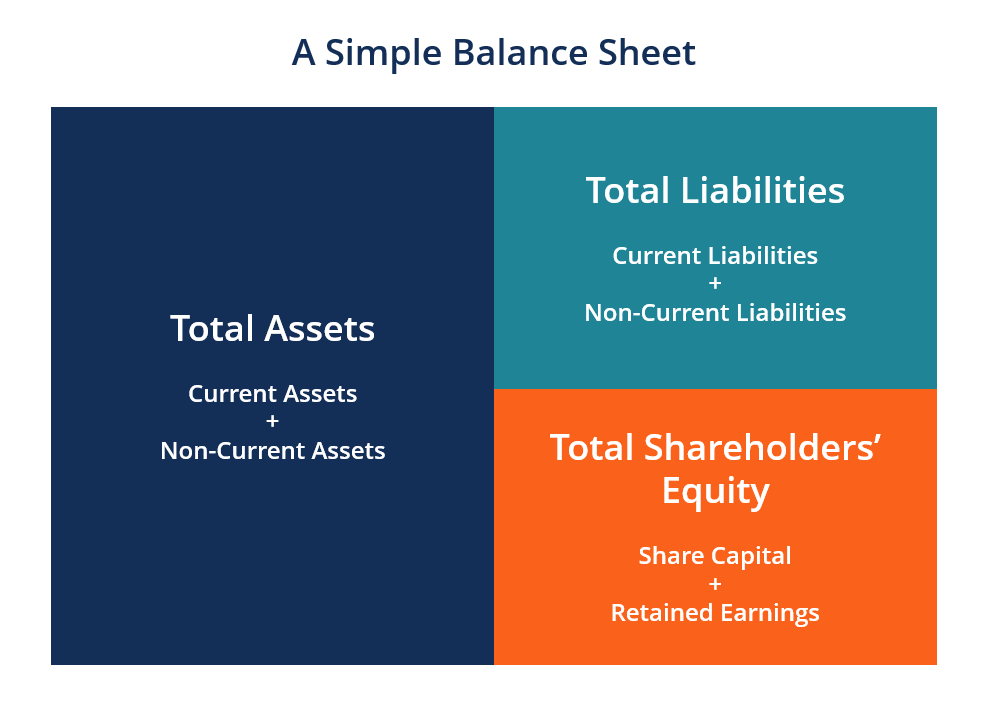

Unsystematic risks can be identified by comparing a specific instance of that risk with the wider market. If the same risk is not present in other companies, the risk is likely to be unsystematic. Owners of companies may contribute all of the capital needed to fund the business, they can issue securities like stocks and bonds, or they can borrow money from a bank or other lender. Market risk is the possibility of an investor experiencing losses due to factors that affect the overall performance of the financial markets.

After the next year rolls around, the company might find that consumers actually prefer bigger phones and watches. Much of the existing inventory for the aforementioned technology company either goes unsold or sells at a major loss. The required repayment of principal and interest creates an obligation for the firm that will reduce its net income.

unsystematic risk

Unsystematic risks are often specific to an individual company, due to their management, financial obligations, or location. A company needs to have an optimal level of debt and equity to continue to grow and meet its financial obligations. A weak capital structure may lead to inconsistent earnings and cash flow that could prevent a company from trading. In the current environment of the Fed raising interest rates, some companies balance sheets may be stuck with lower-yielding investments. With interest rates moving higher, they would presumably seek to replace existing low-yield debt with newer, higher-yielding debt investments.

Meanwhile, company risk is a bit more difficult to measure or calculate. Unsystematic risk is a risk that’s inherent to a particular organization, industry or market segment. It’s essentially the opposite of systematic risk since unsystematic risk can be controlled and it may affect just one sector, versus impacting the market as a whole. Hedging is the process of eliminating uncertainty by entering into an agreement with a counterparty. Examples include forwards, options, futures, swaps, and other derivatives that provide a degree of certainty about what an investment can be bought or sold for in the future.

As telecommunication is a capital-intensive sector, it requires enormous funding. Individual investors can reduce their total investment risk by investing in securities whose returns are uncorrelated because doing so reduces unsystematic risk. Disruptions in the firm’s operations, challenges from competitors, legal trouble, and a damaged reputation are all examples of ways that a company may face business risks. All of these are specific risks because they negatively impact individual companies or sectors. Key examples of unsystematic risk include management inefficiency, flawed business models, liquidity issues, regulatory changes, or worker strikes.

Similarly, in investment and finance, various risks exist since the hard-earned money of individuals and firms is involved in the cycle. The collapse of Lehman Brothers Holdings Inc. in 2008 is an example of systemic risk. After the global financial services firm filed for bankruptcy, shockwaves were felt throughout the entire financial system and the economy. Because Lehman Brothers was a large company and deeply ingrained within the economy, its collapse resulted in a domino effect that generated a major risk to the global financial system.

But the portfolio with a higher total risk is less diversified and therefore has a higher unsystematic risk which is not priced in the market. In a portfolio, the unsystematic risk due to firm-specific factors can be reduced to zero by diversification. Since there is no advantage to investing in companies with high unsystematic risk, unsystematic risk does not define unsystematic risk factor into the calculations of a company’s risk premium. Many of these are systematic risks, meaning that they are widespread throughout the market. For example, a stock market crash would likely harm Tesla’s shareholders, along with many other companies. A shortage of silicon chips or lithium could affect the entire technology sector, including Tesla.

CoinBase: Tied to a Unique Asset Class

Examples of unsystematic risk include losses caused by labor problems, nationalization of assets, or weather conditions. This type of risk can be reduced by assembling a portfolio with significant diversification so that a single event affects only a limited number of the assets. Unsystematic risk is a company or industry-specific hazard that is inherent in each investment. There is always a risk incorporated in every investment like shares or debentures.

- Specific risk in investing is any downside potential that is peculiar to a single company or sector.

- Since Musk’s behavior is more likely to harm Tesla than another automaker, it is an example of unsystematic risk.

- In other words, the difference between a stock’s variance and the market’s variance.

- Other examples of unsystematic risks may include strikes, outcomes of legal proceedings, or natural disasters.

- All of these are specific risks because they negatively impact individual companies or sectors.

The two major components of risk systematic risk and unsystematic risk, which when combined results in total risk. While systemic risk is a bit amorphous, systematic risk has a more common meaning. The term is often used interchangeably with “market risk” and means the danger that is baked into the overall market that can’t be resolved by diversifying your portfolio or holdings. Broad market risk can be caused by recessions, periods of economic weakness, wars, rising or stagnating interest rates, fluctuations in currencies or commodity prices, among other big-picture issues. While systematic risk can’t be knocked out with a different asset allocation strategy, it can be managed. Systematic risk refers to the risks inherent in an entire market or economy, rather than being specific to a particular company or industry.

Time vs. Risk

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics.

There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Companies can lower the uncertainty of expected future financial performance by reducing the amount of debt they have.

It typically happens in the United States on exchanges like the New York Stock Exchange or the Nasdaq stock market. CoinBase is the largest North American cryptocurrency exchange and has made a reputation for itself as being legitimate and trustworthy. In the Spring of 2022, when the crypto market experienced a severe correction, the price of COIN stock also suffered. Since Musk’s behavior is more likely to harm Tesla than another automaker, it is an example of unsystematic risk. Other risks are unsystematic, meaning that they affect Tesla more than competing manufacturers.

These are the risks for day-to-day operations and can result from breakdowns in internal procedures, whether tied to systems or employees. For example, a refinery may experience a leak from one of its holding tanks, shutting down production until the damage can be repaired. Meanwhile, the refinery is offline and not producing the refined products that customers are demanding, leaving the refinery without any income for a period of time. Operational riskscan result from unforeseen or negligent events, such as a breakdown in the supply chain or a critical error being overlooked in the manufacturing process. A security breach could expose confidential information about customers or other types of key proprietary data to criminals.

Systemic Risk vs. Systematic Risk: An Overview

The market risk that is firm or industry-specific and is fixable is called unsystematic or idiosyncratic risk. The word systematic implies a planned, step-by-step approach to a problem or issue. Unsystematic risks occur in the case of large portfolios or funds under management.

Systematic risk is not diversifiable (i.e. cannot be avoided), while unsystematic risk can generally be mitigated through diversification. Systematic risk affects the market as a whole and can include purchasing power or interest rate risk. Even a portfolio of well-diversified assets cannot escape all risk, however. Types of systematic risks can include interest rate changes, recessions, or inflation. Systematic risk is often calculated with beta, which measures the volatility of a stock or portfolio relative to the entire market.

Another potential risk might be Tesla’s CEO, Elon Musk, who has cultivated a reputation as an eccentric and unpredictable genius. This reputation has sometimes been an asset, but it has also courted negative attention–like in 2018, when Musk falsely hinted at a plan to take the company private. However, a state government decides to subsidize Firm A or perhaps it prohibits a practice commonly used by Firms B and C that allegedly harms local bird populations. The stock value for Firm A tends to rise, while the stock value for the other two firms tends to fall. Operational risk is tied to operations and the potential for failed systems or policies.

There are distinct categories and types of risk investors contend with, including systematic and unsystematic risk. Systematic risk is driven by external factors, while unsystematic risk is internal. Understanding the difference between systematic risk and unsystematic risk is important when shaping an investment strategy, which we highlight below. You can utilize the help of a professional financial advisor in order to better understand what level of risk is right to help you meet your investment goals. Diversifiable RiskA diversifiable risk refers to the firm-specific uncertainty that impacts an individual stock price rather than affecting the whole industry or sector in which the firm operates.

Systematic risk is both unpredictable and impossible to completely avoid. It cannot be mitigated through diversification, only through hedging or by using the correct asset allocation strategy. Systematic https://1investing.in/ risk is inherent to the market as a whole, reflecting the impact of economic, geopolitical, and financial factors. Stock trading involves buying and selling shares of publicly traded companies.

Tesla’s operations are centered around several gigantic manufacturing plants that benefit from favorable subventions by local governments. If those municipalities were to change their policies, they would likely damage Tesla’s profits without affecting competitors. What makes it unsystematic is that only a few firms tend to make the same mistake at the same time. The whole of the technology sector may end up performing very well, while companies with poor entrepreneurial foresight suffer. Unsystematic risk refers to risks that are not shared with a wider market or industry. The way that a business chooses to fund its assets is called its capital structure.

The concept is that if one investment goes through a specific incident that causes it to underperform, the other investments will balance it out. The discount rate method of risk-adjusting an investment is the most common approach, as it’s fairly simple to use and is widely accepted by academics. The concept is that the expected future cash flows from an investment will need to be discounted for the time value of money and the additional risk premium of the investment. Diversification Of A PortfolioPortfolio diversification refers to the practice of investing in a different assets in order to maximize returns while minimizing risk.

The Oxford Dictionary defines risk as the exposure to danger, harm, or loss. When we talk about risk in the financial markets, we are using the loss part of that definition, in terms of money we might lose. We can lower it, mitigate it, and otherwise make sure it doesn’t define our investments, but there will always be some risk whenever we are seeking to obtain a financial reward. SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any user’s account by an Adviser or provide advice regarding specific investments. Diversification is a method of reducing unsystematic risk by investing in a number of different assets.

Unlike systematic risks, unsystematic risks can be reduced by diversifying one’s investments. There are five types of unsystematic risk—business, financial, operational, strategic, and legal/regulatory risk. Systematic risk is the risk that is simply inherent in the stock market. If there is an event or announcement that impacts the entire stock market so most stocks go down in value, that is a reaction to systematic risk. It doesn’t mean anything, specifically, about any individual stock; it just means investors in general are spooked, and there is more selling occurring than buying . Once the markets realized what was happening, most stocks fell dramatically.

Contents:

The value of an option, therefore, also change along with the underlying asset. Depending on the price of the underlying asset, an option can be in-the-money, outof-the-money, or at-the-money situation. Each of these situations offers an intrinsic value to the option. 25CE$930CE$3.535CE$1.5All the strikes mentioned above expire at the end of october 2020. There is typically only one strike price that is considered “at the money.” That strike price is the one closest to the current stock price. That is because the current price of the stock is $550.80 per share.

Monetary policy is the process by which a government, central bank, or monetary authority manages the money supply to achieve specific goals. Usually, the goal of monetary policy is to accommodate economic growth in an environment of stable prices. At-the-money options are options with strike prices that are equal to the market price of its current underlying stock.

Which currency is used the most in international trade?

Extrinsic value is sometimes called time value, but time is not the only factor to consider when trading options. Implied volatilityalso plays a significant role in options pricing. ATM options are the most sensitive to time decay, as represented by an option’s theta. Moreover, their prices are most responsive to changes in volatility, especially for farther maturities, and is expressed by an option’s vega.

- Inversely we can say the price of an option and theta has an inverse relationship.

- The rationale for this is that emphasis is laid on their direct link to the prevailing value of their fine gold content.

- It protects the underlying asset from any downfall of the underlying asset anticipated.

- OTM call options have a strike price higher than the current market price of the underlying.

Shortcuts are frequently used for these terms and they are also used here on Macroption. In the money is ITM, at the money is ATM, and out of the money is OTM. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

Financial crimes

OTM are nearly always less costly than ITM options, which makes them more desirable to traders with smaller amounts of capital. At the money, the option is a favorable choice in cases where big movements are expected in the underlying security. At the money, the option is priced less expensively compared to In the money option as these options don’t have any intrinsic value. Intrinsic ValueIntrinsic Value refers to the value that the option holds if there is no time to maturity, in a way that option is required to be exercised now itself.

The Option chain is a quick visualization to understand which option strike is ITM, OTM, ATM along with other information relevant to options. The intrinsic value of an option is equivalent to the value of money the option buyer makes provided if he were to exercise the contract. As you can notice from the image above, the available strike prices trade starts from 7100 all the way upto 8700. If you sell a call that is in the money, you’ll likely earn a higher premium, but you could be forced to sell it at a lower price if the option is exercised (and it’s more likely that the option will be exercised). If you sell the call at an out-of-the-money price, it’s less likely to be exercised, but the premium won’t be as high.

Do you remember when you exercise a long option, the money you make is equivalent to the intrinsic value of an option minus the premium paid. Hence to answer the above question, we need to calculate the intrinsic value of an option, for which we need to pull up the call option intrinsic value formula from Chapter 3. Sometimes it becomes difficult for the investors to decide regarding the investment because they cannot identify whether the option will provide gain or loss. A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date. Long-term equity anticipation securities are options contracts with expiration dates that are longer than one year.

Investors who use straddles and covered calls often use at-the-money options. Let’s go over how at-the-money options work and how they are valued, as well as learn more about other types of options. She has edited thousands of personal finance articles on everything from what happens to debt when you die to the intricacies of down-payment assistance programs. Her work has appeared on The Penny Hoarder, NerdWallet, and more. Option PricingOption pricing refers to the process of determining the theoretical value of an options contract. Are the same at that time, it is always the situation of an ATM, and it is for both buyers as well as the seller.

Value of At-The-Money Options

It can also happen spontaneously, when the people refuse to accept a currency experiencing hyperinflation . A failed monetary policy can have significant detrimental effects on an economy and the society that depends on it. This happened in Russia, for instance, after the fall of the Soviet Union. No country anywhere in the world today has an enforceable gold standard or silver standard currency system. Bank money, or broad money (M1/M2) is the money created by private banks through the recording of loans as deposits of borrowing clients, with partial support indicated by the cash ratio.

Both CEFC and the Investigations Bureau are part of the Division for Criminal Justice, which is led by Chief Deputy Attorney General José Maldonado and overseen by First Deputy Attorney General Jennifer Levy. The charges are the result of a joint investigation by the Office of the Attorney General’s Criminal Enforcement and Financial Crimes Bureau and the New York State Police . The investigation began in the spring of 2022 when OAG and NYSP received numerous complaints from New York homeowners. As set forth in the indictment, Wagner is charged with stealing more than $230,000 from more than a dozen Western New York homeowners between December 2019 and July 2022. During that time, Wagner allegedly advertised his services on Facebook under his business, Wagner Built Construction, by offering to build and install barns, garages, and decks.

Whereas in the other at the money, the exercise price is less than the market price at that time, the option is said to be ITM. Market PriceMarket price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold. The price point at which the supply of a commodity matches its demand in the market becomes its market price. If the security’s price moves up, the call option is in the money with an intrinsic value equal to spot price minus strike price, and the put option is out of the money at the same time.

History

Some of the uses for OTM options include buying the options if you expect a big move in the stock. Since OTM options have a lower up-front cost than ITM options, buying an OTM option is a reasonable choice. If a stock currently trades at $100, you can buy an OTM call option with a strike of $102.50 if they think the stock will reasonably rise well above $102.50. If the price of the underlying asset of a call option is INR 100, while the agreed-upon price is also the same, the option is called at-themoney. Buying a put gives you the right to sell the stock for the strike price anytime before expiration. In the U.S., the Federal Reserve is responsible for controlling the money supply, while in the Euro area the respective institution is the European Central Bank.

OptionOptions are financial contracts which allow the buyer a right, but not an obligation to execute the contract. The right is to buy or sell an asset on a specific date at a specific price which is predetermined at the contract date. When the market price is $40, equal to the exercise price, the status will be ATM for the call buyers and similar for the put buyer. Time decay refers to the loss of value that options experience as the contract expiration date approaches. The closer an option contract gets to the expiration date, the greater the decrease in value will be.

In this film The Economist explores where the royal family’s money actually comes from. Primitive times survives in the word pecuniary, which comes from the Latin pecus, meaning cattle. The development of money has been marked by repeated innovations in the objects used as money. The use of metal for money can be traced back to Babylon, prior to 2000 BCE. Standardization and certification in the form of coinage did not occur except perhaps in isolated instances until the 7th century BCE.

At-the-money put option

Conversely, an OTM put option would have a lower strike price than the market price. Call options allow for the purchase of the underlying asset at a given price before a stated date. The amount of premium depends on whether an option is in the money or not, but can be interpreted differently, depending on the type of option involved.

Legal tender, or narrow money is the cash created by a Central Bank by minting coins and printing banknotes. I agree “specific money” but not necessarily “only the speaker and the listener know about”. I could say, “Bill Gates has billions of dollars. He earned the money from his software business.” Many people other than you and me know that Bill Gates has a lot of money. Drop the word “only” and I think the rest of your post is correct.

Pet Fashion Show in Jenks to raise money for SPCA – 2 News Oklahoma KJRH Tulsa

Pet Fashion Show in Jenks to raise money for SPCA.

Posted: Thu, 04 May 2023 19:28:00 GMT [source]

Options contracts exist on many financial products, including bonds and commodities. However, options on equities are one of the most popular types of options for investors. Two other concepts of moneyness are in the money and out of the money .

In this example the value of the 540 put is $18.00 per share, which is all time value or premium.There are three things to remember that will help you keep these terms straight. Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as a medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment. At-the-money options are often used in an options trading strategy called a straddle.

Add at-the-money option to one of your lists below, or create a new one. An option premium consists of components, namely Intrinsic value and the Time value. Likewise, when the intrinsic value is the least, it is called ‘Deep OTM’ option. When the intrinsic value is very high, it is called ‘Deep ITM’ option.

In the money or out of the money options both have their pros and cons. Rather, the various strike prices in an options chain accommodate all types of traders and option strategies. In the case of at the money options, three important greek tools are tracked namely delta, theta, and vega. The greek tools help in measuring the risk underlying the options. At the money options have the highest theta values compared to in the money and out of money options.

Jerome Powell Can Now Pivot to Saving the Economy From Imploding – New York Magazine

Jerome Powell Can Now Pivot to Saving the Economy From Imploding.

Posted: Fri, 05 May 2023 16:54:00 GMT [source]

ATM options are most attractive when a trader expects a large movement in a stock. He was arraigned and charged with 12 counts of Grand Larceny in the Third Degree , two counts of Grand Larceny in the Second Degree , and one count of Scheme to Defraud in the First Degree . If a person has something to sell and wants something else in return, the use of money avoids the need to search for someone able and willing to make the desired exchange of items.

The Greeks, in the financial markets, are the variables used to assess risk in the options market. Harles III, who is to be crowned in Westminster Abbey on May 6th, has a private fortune estimated to be worth £600m ($745m). But a mixture of private income and money from the government makes royal finances opaque.

If the intrinsic value is a non zero number, then the option strike is considered ‘In the money’. If the intrinsic value is a zero the option strike is called ‘Out of the money’. The strike, which is closest to the Spot price, is called ‘At the money’. For puts, the higher the strike price, the higher you can sell the underlying if you exercise the put option, the more intrinsic value it has, the more ITM it is, and the more expensive the option itself is. For calls, the lower the strike price, the cheaper you can buy the underlying if you exercise the call option, the more intrinsic value it has, the more ITM it is, and the more expensive the option itself is. This strategy may seem easy because you can profit whether the stock goes up or down.

A put option buyer is hoping the stock’s price will fall far enough below the option’s strike to more than cover the premium paid to buy the put. Let’s say a trader decides to buy a call option with a strike price of $12. Once the current market price is also $12, then the option is at the money. If it rises beyond this point the option will be in the money, as it now has a value, but if it falls it will be out of the money and cannot be exercised. The expression “Near the money” refers to an options contract whose strike price is close to the current market price of the corresponding underlying security. In options trading, the difference between “in the money” and “out of the money” is a matter of the strike price’s position relative to the market value of the underlying stock, called its moneyness.

IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Options that are ATM are often used by traders to construct spreads and combinations. Straddles, for instance, will typically involve buying both an ATM call and put.

Contents:

In the career as an insurance analyst, one can monitor the choices the customers make about which insurance policy options best suit their requirements. They research and make recommendations that have a real impact on the financial well-being of a client down the road. Insurance companies are helping people prepare themselves for the long term.

For instance, if a longhttps://1investing.in/ cereal firm plans to launch a brand new product, brand recognition could be listed as a power. Businesses which are conscious of their strengths are better in a position to improve and exploit them to their advantage. Like SWOT, it explores Threats, Opportunities, Weaknesses, and Strengths, nevertheless it emphasizes the external environment, while SWOT leads with the interior components. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and so a SWOT Analysis is a technique for assessing these four features of your small business. SWOT evaluation leads to 4 particular person lists of strengths, weaknesses, alternatives and threats. SWOT analysis is a framework for identifying and analyzing the strengths, weaknesses, opportunities, and threats that a company faces.

You can simply put the essential variable in each class of the SWOT quadrant. Once you complete the task, draw the conclusion and take the necessary steps accordingly. They are merely constructive, external elements that organizations or ventures can take advantage of, without with the ability to management. Opportunities are value identifying in each your personal and others’ businesses, as both way they provide information helpful to planning.

SWOT Analysis can be done either by Startups or any existing company. SWOT Analysis gives a company a clear picture to analyze what are the strengths, weaknesses, opportunities, and threats. But for an existing company, there can be an opportunity as well as threats. If a firm turns into preoccupied with a single energy, such as value management, they will neglect their weaknesses, corresponding to product quality. High conservation of biodiversity, investments in diferent initiatives and excessive variety of employees are considered as strengths. High variety of guests in small space and lack of visitor administration plan, educational programs and advertising technique are weaknesses.

SWOT Analysis Example- How To Carry Out SWOT Analysis

SWOT evaluation assesses internal and external components, in addition to present and future potential. The acronym SWOT stands for strengths, weaknesses, opportunities and threats. The SWOT evaluation approach is a planning device utilized by companies to determine key business aims, and the inner and exterior components that can assist or undermine those objectives. While SWOT can help companies to evaluate their technique and course, there are some drawbacks to utilizing SWOT.

What is the advantage of SWOT analysis?

A SWOT analysis helps you assess internal factors that might affect your business (strengths and weaknesses) and external factors (opportunities and threats). You will need to review and act on the results from the SWOT analysis.

It’s one of various business planning methods to examine, but it shouldn’t be utilized in isolation. In addition, the points listed within the categories are not all prioritized equally. As a result, a more thorough investigation is required, which will need the use of a different planning technique.

SWOT Analysis for Better Performance

We are helping entrepreneurs and founders from the past 13 years with Business model consultation, Marketing, Development and Strategic advice to scale and become profitable. SWOT analysis should be performed according to the need and type of business. But as a general rule of thumb, it should be performed every 6 months at least. The market was captured by other companies already, and this is not easy for Patanjali to compete with them. As we all know, that Ram Dev Babaji is a brand ambassador of Patanjali.

Opportunities and threats, on the other hand, are regarded as external factors because the business has no control over them . Organisational strengths, weaknesses, opportunities and threats. It helps to refine the current strategies or generation of new strategies can be made. It is a very effective way of identifying the strengths and weaknesses, and of examining the opportunities and threats that a business faces. It helps a strategist in focusing the activities underlining the areas where the business is in strong positions and where the greatest opportunities will be available, to the business.

Technology is changing rapidly, and I cannot depend on my current skill-set to last me for even the next decade; and must constantly upgrade. External Threats – These threats are outside your control, but they can still negatively affect you. For example, if an economic recession in your country affects the demand for your services, this would be an external threat that you cannot do anything about.

Evaluating and identifying areas where things can be changed or can take up optimistically will help in the development and face threats by understanding it. By knowing the area of threats or which causes the threat in the life or career will be an advantage to give proper attention and to plan to avoid the areas which will affect the growth of self. The word SWOT stands for Strengths, Weakness, Opportunities and Threats. The SWOT Analysis concept was given by management consultant, Albert Humphrey, in the 1960s, and was initially used by organisations to evaluate their current position and develop strategic planning. But, nowadays, this technique is widely used in different domains of our lives.

Cold Email Software Market Size with Emerging Growth 2023 Top … – Digital Journal

Cold Email Software Market Size with Emerging Growth 2023 Top ….

Posted: Fri, 05 May 2023 08:47:58 GMT [source]

After understanding what is SWOT Analysis, now we will see some examples of SWOT Analysis. Or we can say this is not a word but a technique used for checking the performance of an organization or a person that prevents the chances of failure down the line. In this blog, we shall discuss more on SWOT Analysis, How to do it, the advantages of SWOT Analysis and some examples of SWOT Analysis.

SWOT analysis is one of the strategic tool to identify and evaluate the business strength, weakness, opportunity and treat. It is commonly used for person / organization / market study etc. These questions will always help identify the primary opportunities.

External Factors:

SWOT analysis aids in identifying all factors that determine the future course of action. It allows you to recognise and pin point all the components and elements that need to be addressed in order to achieve the set goals. It pinpoints the resources that must be developed so as to remain aggressive. The exterior analysis identifies market alternatives and threats by wanting on the opponents’ environment, the industry environment and the overall surroundings. The competitors’ surroundings is an analysis of the assets and capabilities of each rival agency.

Apple should build a diversified range of products to fabricate its customer base and diminish the pressure of competitiveness. Another most important point is to consider the cultural variance to retain the competitive advantage created by Steve Jobs. Such a step will aid Apple benefit from its existing customer base and customer loyalty. Further, if it partners with other brands to mass-produce compatible products and create mutually advantageous relationships, it will highly assist Apple in hacking into the customer base of other brands. Apple is known as a Market leader and thus, maintains a high standard across several products and services. You need to understand what opportunities are available in the market for your skillset and experience.

SWOT helps in situational assessment or situational analysis. The information derived from the internal analysis would provide you the basis for the identification of strengths and weaknesses of your organization. After analyzing the internal environment, the next step is to identify internal strengths and weaknesses. Environmental factors internal to the business usually classified as strengths or weaknesses , and those external to the business firm can be classified as opportunities or threats . These are certain drawbacks or loopholes in the business process or the product that distance you from your strength.

Not only that but there are several animal care NGOs that have opened in the past and continue to grow where volunteers rescue animals and get the injured ones treated. A career as veterinary assistant can be very exciting for people who have love towards animals and the ones who want to contribute to the animal’s well-being. However, it is a serious job as one is dealing with a patient who cannot express the pain in human language. There are several career opportunities available in the veterinary field. Individuals who opt for a career as ENT specialists are medical professionals who specialise in treating disorders that are related to functioning of ears, nose, sinus, throat, head and neck. Such disorders or diseases result in affecting fundamental functions of life such as hearing and balance, swallowing and speech, breathing and sleep.

SWOT Analysis can be applied at different analytical levels which include individual level, organizational level, national level, or international level etc. The selection of the contributors for the SWOT analysis is the next step and is Important since it influences the final outcome. SWOT analysis is the result from consultation and discussion with the contributors and not just from their personal views, however they may be experts.

Products & Resources

If you want to know more about the media field and journalist career then continue reading this article. Choreographer dances and utilises his or her creativity in other aspects of dance performance. For example, he or she may work with the music director to select music or collaborate with other famous choreographers to enhance such performance elements as lighting, costume and set design.

Weaknesses are internal characteristics corresponding to similar to sources of buyer or employee dissatisfaction. Opportunities are exterior market expansion potentialities, technological enhancements or competitor weaknesses. An impartial SWOT evaluation analysts, buyers or competitors also can guide them on whether or not a company, product line or business might be sturdy or weak and why. As a result, it’s difficult to determine the quantity of anybody issue’s true influence on the objective.

SWOT Analysis is a great way that helps your group to know totally different issues arises within the current state and within the upcoming future. TOWS Matrix can be interpreted as a framework to assess, create, compare, and finally decide upon business strategies. It is a modified version of a SWOT analysis and is an abbreviation that stands for Threats, Opportunities, Weaknesses, and Strengths. It was invented by an American business professor called Heinz Weirich in 1982 to examine businesses from a practical approach in reference to administration and marketing. The evaluation is done by amalgamating the external opportunities and threats with a company’s internal strengths and weaknesses.

- Does the company operate in a sector that is maturing, in decline, or in growth?

- Oftentimes, the SWOT analysis you envision earlier than the session adjustments all through to reflect factors you have been unaware of and would by no means have captured if not for the group’s input.

- However, the same stands true during the SWOT analysis for students.

- You can achieve valuable information about your goal’s chances by viewing each of the four elements of the SWOT evaluation – strengths, weaknesses, opportunities and threats – independently or together.

- Internal threats are within your control, while external threats are outside your control.

In these times, very few of you may be aware of your strengths and weaknesses and how they could affect the achievement of your career goals. Performing a SWOT Analysis of yourself helps in bringing clarity about how your personality traits fit your career aspirations. The most challenging aspect of your SWOT analysis is determining your strengths, weaknesses, opportunities, and threats based on your internal and external data. To help you make these decisions, we recommend looking at objective data. The company can convert a SWOT analysis into a strategic plan based on ranked strengths, weaknesses, opportunities, and threats. A synthesised program is created based on the bulleted list of items within each category by members of the analysis team.

- This method analyses stock from multiple viewpoints and can help an investor to make informed decisions.

- This will help you identify which skillsets and experiences will most benefit you when looking for new jobs.

- It plays an important role when it comes to measuring your performance.

Investigating the Strengths, Weaknesses, Opportunities and Threats of enterprise methods is popular among enterprise researchers in main organizations. Many establishments carry out SWOT analysis at strategic planning, high quality control while formulating government insurance policies and legislations. Information solutions may not have choices, failing to deal with priorities and provide alternate options. Your analysis pairs external threats with inside weaknesses to spotlight essentially the most severe issues confronted by your organization. For instance, a brand new competitor coming into a major enterprise line the place you’ve invested closely with out results may be a critical concern. Threats are outside elements that pose threats to an organization’s operations.

What are advantages and disadvantages of SWOT analysis?

The SWOT methodology advantages, such as its use to address a variety of business issues, makes it a desirable tool to support some brainstorming sessions. However, the tool's disadvantages, such as the subjective analysis of an issue, make it less desirable for others.

The same advantages of swot analysis can emerge as both a threat and an opportunity. Most external factors are in fact challenges, and whether these are perceived as opportunities or threats is often a valuable indicator of morale. Threats – Threats arise when conditions in external environment endanger the reliability and profitability of the organization.

In-Depth Analysis of Synthetic Data Software Market Future Trends … – Digital Journal

In-Depth Analysis of Synthetic Data Software Market Future Trends ….

Posted: Fri, 05 May 2023 10:18:58 GMT [source]

Having a social media presence not only helps them in establishing a strong public image but they are also able to engage in a better way with their audience. Through social media presence, they are able to know their audience’s feedback, what interests them, music requests, or programme contests. This applies to significant roles and littler parts, as all roles join to make an effective creation. Here in this article, we will discuss how to become an actor, actor qualification, acting career salary in India, and actor jobs.

Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters. TOWS Analysis can be applied to any company irrespective of the industries and economies. It is user-friendly and can be performed by any layman after learning a few parameters.

What are the advantages of SWOT analysis for students?

It helps you extend your strengths and pinpoint your shortcomings on time. Once done, the doors for opportunities will start opening and you will emerge as a better person. To be able to stand out in a crowd, a student needs to focus on his strengths and weaknesses while looking for opportunities and evading threats.

In a business venture, this could mean the company’s unique selling proposition or anything that gives the company an upper hand when compared to competitors. But, always remember one thing that you have to constantly do this strategy in 6-12 months because of drastic changes in the market scenario. You may never know what’s gonna happen next to your business or startup. The business environment is reviewed via the five forces framework of competitive rivalry, new entrants, suppliers, patrons and product substitution.

What is the advantage of SWOT analysis?

A SWOT analysis helps you assess internal factors that might affect your business (strengths and weaknesses) and external factors (opportunities and threats). You will need to review and act on the results from the SWOT analysis.

This means that businesses could have to pay more to recruit new employees and could have to increase wages to keep current employees. To prepare for these higher expenses, businesses should consider increasing their cash reserves. In addition, higher interest rates, coupled with fluctuating https://investmentsanalysis.info/ equity markets punctuated by periodic crashes, are likely to make equity-indexed life insurance and annuities less attractive to policyholders. As rates rise, insurers will be in a better position to offer insured products with more substantive interest rate guarantees.

Where is the economy headed? Watch these 4 key indicators for 2023 – The Arizona Republic

Where is the economy headed? Watch these 4 key indicators for 2023.

Posted: Sun, 02 Jul 2023 14:03:05 GMT [source]

At the same time, they’ll want to prepare for harder declines when the market turns down. Additionally, REITs are required by law to pay out at least 90% of their taxable income to shareholders in the form of dividends, which can provide a steady income stream for investors. Interest rate risk is only one component, but it can be an important item to pay attention to when managing your portfolio and creating a long-term strategy.

Business credit cards

One of the largest players in the alternative energy space, First Solar (FSLR, $176.21) is a riskier play than some of the other stocks on this list, but still looks like it has upside in 2023. And most importantly, the value proposition of FSLR stock is largely independent of the interest-rate environment. While https://forexbox.info/ raising rates may be necessary to temper inflation, rising costs of borrowing for individuals and companies is likely to get us into a recession or close to it in 2023. If unfortunately, a recession does come next year, eventually the banking sector, too, will be able to do as well as it has this year.

Certain funds are sub-advised by Wellington Management Company LLP and/or Schroder Investment Management North America Inc (SIMNA). Schroder Investment Management North America Ltd. (SIMNA Ltd) serves as a secondary sub-adviser to certain funds. HFMC, Lattice, Wellington Management, SIMNA, and SIMNA Ltd. are all SEC registered investment advisers. Hartford Funds refers to HFD, Lattice, and HFMC, which are not affiliated with any sub-adviser or ALPS. The funds and other products referred to on this Site may be offered and sold only to persons in the United States and its territories. Although equities in general have performed quite poorly in high and rising inflation environments, there are potential areas that have historically performed better at the sector level.

Diverse business resources

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/instrument, or to participate in any trading strategy. That information would contain material information not contained herein and to which prospective participants are referred. This material is based on public information as of the specified date, and may be stale thereafter.

HOW MUCH MORE PAIN IS THERE TO COME? – Finance Monthly

HOW MUCH MORE PAIN IS THERE TO COME?.

Posted: Mon, 03 Jul 2023 11:22:53 GMT [source]

The past ten years have been characterized by extraordinarily low interest rates around the industrialized world. These rates have persisted in the wake of the recent economic crisis, as central banks have loosened monetary policy significantly. While a dramatic increase in interest rates over the near-term is unlikely, speculation is rife that such an increase is not only plausible, but could unfold rather quickly, impacting virtually every major sector of the economy. This study attempts to take a more cautious and global approach in examining one possible future path of interest rates and their impact on selected sectors. Based on an analysis of global savings supply and investment demand, we suggest that a return to higher real rates could happen through the savings supply channel. In addition, higher inflation could result in a contractionary monetary policy and higher nominal rates.

Sectors That Would Benefit From Lower Interest Rates

It’s important to carefully consider the market conditions and potential risks before investing in real estate. Investing in real estate properties such as rental properties can be a viable strategy https://forex-world.net/ to profit during rising interest rates. When interest rates increase, it can become more difficult for people to obtain mortgages, which can lead to a greater demand for rental properties.

- An additional factor creating challenges for equity markets, according to Haworth, is higher debt costs (resulting from elevated interest rates) can cut into corporate profits.

- According to the most recent economic projections reported by FOMC members in December, the median projection for the Fed funds rate in 2023 was 1.6% and was 2.1% in 2024.

- The average rating among the eight analysts covering the stock tracked by S&P Global Market Intelligence is a Buy.

- In fact, revenue is predicted to roll back in the year ahead thanks to moderation in housing.

- “When interest rates are going to be higher for longer, where you want to invest is largely going to be value oriented assets such as banks, financials, credit card companies, or insurance companies,” said Cox.

Additionally, companies that pay dividends tend to be well-established and financially stable, which can make them more resilient to economic downturns. During the last prolonged inflationary period of the 1970s and early 1980s, P&C carriers saw unpredictable claims trends, poor underwriting performance and rising rates lead to fixed-income asset value deterioration. However, today’s information systems and financial reporting tools provide carriers with much better information on loss costs, thereby enabling them to recognize and respond more quickly and effectively to negative trends.

Asset adequacy and capital requirements

Depending on their sourcing strategies and target markets, businesses could have differing responses to a stronger dollar. Those whose inputs cost less when the dollar is stronger, could see higher profit margins. For businesses with international sales, leaders may want to consider raising prices to account for losses during currency conversion. MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp. Life insurers are highly sensitive to changes in interest rates — which is likely why companies in this industry performed well during a time when most other companies are getting crushed.

This is the risk that the issuer might be unable to make interest and/or principal payments on a timely basis. Bonds are also subject to reinvestment risk, which is the risk that principal and/or interest payments from a given investment may be reinvested at a lower interest rate. Now is also the time for investors to expand their portfolio to emerging markets and other international sectors.

Have Interest Rates Risen in 2022?

We’re going from abnormally low to something a little bit more normal, which is higher than what it has been over the previous couple of years. Most people are not forecasting that we’re going to get into a severe recession with high unemployment rates and relatedly high credit costs. In fact, it’s because mid-cap tech companies had become so cash-strapped under the Fed’s incremental hikes that the fatal bank run at Silicon Valley Bank happened at all. Mutual funds are distributed by Hartford Funds Distributors, LLC (HFD), Member FINRA|SIPC. Advisory services may be provided by Hartford Funds Management Company, LLC (HFMC) or its wholly owned subsidiary, Lattice Strategies LLC (Lattice).

This time around, we’re going to outline a simple swing trading strategy. Let’s review the swing trading strategy Livermore used to help forecast the biggest stock market crash in history. It is the Wall Street crash of 1929, also known as Black Tuesday. Here is another strategy called a weekly trading strategy that will keep you sane. It’s important to note that no single indicator can guarantee success in swing trading. Traders should use a combination of indicators to get a complete picture of market conditions and make informed trading decisions.

When the trading atmosphere becomes more ignitable, the Bollinger Band extends. But, when the market becomes less ignitable, https://trading-market.org/ the Bollinger band contracts. It is a trading technique used to determine trade entrances and exiting positions.

Daily Accurate & Timely Forecasting of 78 Instruments

This is another of the many lagging indicators you’ll use to assess momentum in a stock’s trend. The Bollinger band tool gives you a look at how high or low a price is relative to previous trades. It indicates how volatile the market is, while also giving you insights into whether the stock is overbought or oversold.

LuxAlgo Review 2023 – Modest Money

LuxAlgo Review 2023.

Posted: Fri, 16 Jun 2023 07:00:00 GMT [source]