Content

- Tip #4: Be sure your construction bookkeeping system accounts for contract retainage on your invoices

- What to Consider When Choosing One of the Best Construction Accounting Software Programs

- General Contractors & Builders

- Want More Helpful Articles About Running a Business?

- Accounting Methods for Canadian Contracting Firms

- Overheads

Construction contracting has several distinct factors that differ from other industries, like manufacturing or retail. You can go to a bank or credit union to set up a company checking account that suits the needs of your firm. Looking for a small change that can make a big difference in your business and help you provide better service? Being the owner of a business — especially in construction — means there’s always a lot on your plate. Not only are you the face of the company, but everyone is looking t…

- We know exactly how to manage your tax & financial records to help you grow and scale your contracting business.

- Job costing also can help you determine which types of projects are profitable and which ones to avoid.

- The first step for all construction firms is to open a separate business bank account that will be used exclusively for your business.

- Many of the best accounting software for contractors programs allow users to integrate their existing systems.

- You’ll also want to categorize these expenses by service, and by individual job so you can easily track how much money came in as well as how much you spent on expenses.

- For federal projects, allowable wages as defined by the Davis-Bacon Act are publicly posted information.

For construction companies, things pick up an added layer of complication; construction jobs usually involve contractors, rental equipment, lots of overtime and the occasional job hiccup. It’s best to keep financial records timely, neat and accurate, because with so many construction bookkeeping things going on at once, it can be easy to get behind on required payments. Contrast this with a construction company and the differences become sharp. First, different jobs require different materials, the prices of which can vary wildly depending on what’s needed.

Tip #4: Be sure your construction bookkeeping system accounts for contract retainage on your invoices

Because revenue is recognized after expenses and revenue have occurred, this method of income recognition is not GAAP-approved. As a result, contractors in multiple jurisdictions have to watch out for double taxation. Chiefly, this can be a problem where an employee resides in one state and works in another.

Overhead in construction can be a lot and sometimes forgotten about when estimating a job. This is usually because when you are quoting a job, you will be thinking about labor, materials, and subtrades. You are focusing on what is needed to complete the project, so it is easy to forget about some, or all, of the ‘extras. And let us show you how we can help you grow your construction company or contracting business and achieve better bookkeeping results. For most applications, the percentage completion method is preferable, though it requires more ongoing bookkeeping work.

What to Consider When Choosing One of the Best Construction Accounting Software Programs

The company must also ensure it complies with local wage scales and regulations in effect at each site, and it may need to purchase materials or rent machinery from outlets near each site. Many contractors choose to lease rather than purchase vehicles, and lease accounting brings its own challenges. This is based on a detailed estimate that presents the total cost of a project in its entirety. If you are a builder that consistently puts out the same project and you know all of your exact costs, this can work for you.

How do you account for a construction company?

- Separate Personal and Business Expenses.

- Break Down Project Costs—Job Costing.

- Record Day-to-Day Financial Transactions.

- Select Revenue Recognition Methods.

- Track Business Expenses.

- Reconcile Bank and Supplier Statements.

- Pay Estimated Taxes.

Make sure also to include miscellaneous expenses such as travel costs, professional services fees, and marketing and advertising costs in your overhead expenses. Manual job costing can be very time-intensive, especially when it comes to complex projects. However, you can simplify the entire process with the help of software. If you operate across state lines, you may also need to account for additional tax payments. Construction work is fast-paced and requires you to manage multiple operations at once. Setting aside a specific amount of time every day or week to update your financial records and check for disparities can save you time and effort in the long run while ensuring your bookkeeping is accurate.

General Contractors & Builders

The system of categories the contractor uses across all of their jobs is called the job cost structure. On top of distinct project requirements, construction also features long and often seasonal production cycles. Because production can be less predictable, contractors often aren’t able to retain large amounts of inventory. As a result, the cost and availability of production inputs can fluctuate and require special, careful tracking and planning. Similarly, in contrast to retail and manufacturing, production primarily happens on different job sites rather than fixed locations like plants.

Outsourcing to third parties who are familiar with the laws and regulations may be the best option for you to get your business off to a successful start. In many industries, wages are determined by simply investigating the local market rate and minimum wage requirements for various roles. Though that’s also true for some construction jobs, specific rules apply to public projects and the use of union labor. In many industries, billing takes place at the time of sale or on a fixed monthly schedule — think of buying office supplies or subscribing to a streaming service. In construction, billing can be much more complex, largely because of the long-term and flexible nature of many projects. If you do choose to use software, you may still want to ask an accounting professional to help you set it up.

Want More Helpful Articles About Running a Business?

Virtual Construction Assistants have a lot of experience working with a wide range of contractors in the construction industry. Construction expense reports are compiled by recording the purchase as an expense on the income or profit and loss statement. We’ll modify our services accordingly to accommodate changes and seek improvements where necessary.

How do you record construction?

- Determine which expenses are CIP. You need to determine which costs relate to the project in progress.

- Identify the expenses.

- Log expenses.

- Transfer the enter construction-in-progress amount when the project is finished.

We will cover how construction bookkeeping differs from bookkeeping in other industries and offer some construction bookkeeping tips on how to make your construction bookkeeping solution an easier process. Not only does bookkeeping help manage expenses but it allows you to make better business decisions down the line (it’s also very easy!). It includes jobs like recording financial transactions and completing payroll. All of these factors make construction bookkeeping an essential element for businesses. With so many moving parts, it is easy for records to be forgotten, lost, or not entered in the books at the right time.

Content

The accrual is the most common method used and also a standard method under GAAP acceptance. Of course, the ASC 606 rule provides many other important standards for contractors to follow. That includes identifying whether they need to count a project as one contract or multiple contracts, how to determine the contract price, and how to allocate the sales.

- This method of revenue recognition allows you to recognize your gains and losses related to the project in every reporting period during which the project is active.

- Accurate job costing, for example, can help businesses see where they’re making or losing money and react quickly before profitability is negatively impacted.

- As a type of progress billing, AIA billing invoices the customer based on the percentage of work completed for that billing period.

- As a result, the materials are usually easy to estimate entering into a contract unless something surprising is found while doing the work.

- With supply chains in such bad shape recently, maintaining a solid inventory of materials could allow you to stay operational while competitors are waiting for their shipments.

Construction financial statements are important to keep track of your business and evaluate where you can improve or double down on. The more you can become familiar with these statements, the more you can grow your business in the right areas and identify those areas that could be slimmed down or use some work. Inefficiencies can be identified and the next piece of equipment can be identified as well as where the money is coming from. This is a much better payment plan than getting paid in a lump sum at the end of a project. Having money flowing in periodically throughout the project significantly enhances your cash flow. This specifically includes how much money is coming in and from where and how much is going out and to what.

Q. Can I use construction accounting software on my own?

Use calendars to track the billing and invoicing cycles so that neither are overlooked. This can be automated with most modern accounting software suites, but even a paper calendar will help. Construction contracts are normally paid out on a schedule, as the project progresses, with a portion of it held back until completion. Based on the contract, schedule accounts payable as needed so that no accounts go overdue.

Retainage is commonly applied to both private-sector and public-sector projects; the regulations for handling retainage vary from state to state. Because many contractors operate on relatively low profit margins, the amount withheld for retainage can represent a large portion of a project’s profit. To mitigate their risk, contractors may in turn withhold retainage from their subcontractors.

Change orders

For contractors, revenue recognition is a complex topic, largely because of the long-term nature of many projects. The choice of revenue recognition method depends on factors such as the size of the contractor’s business as well as the duration and type of projects the company works on. Bookkeeping for a construction company can sometimes be considered challenging because there are many other construction bookkeeping moving parts and uncertainties, compared to other industries. Supplies prices, global competition, labour prices, and much more impacts the construction industry in Canada. That is why we have created this guide filled with bookkeeping tips for construction companies. Keeping backups of your transactions and books is crucial for auditing and for avoiding mistakes in your bookkeeping.

But you might need to upgrade your bookkeeping efforts and software to keep a more accurate inventory of materials and their related expenses. Doing so should enable you to more easily see where your resources are going and budget accordingly. As you record information, whether from expenses you’re paying or revenue you’re receiving, include key details such as the precise name of the other party, account number, date and so forth. Cash flow statements help with forecasting and ensure that you have money to cover your expenses. Cash flow statements break down how much cash entered the business and how much you spent during a given period. Income statements, also known as profit and loss statements, summarize revenue and expenses accrued and the net profit or loss during a period.

Bookkeeping and Accounting Servicesfor Construction Companies

Contractors are particularly vulnerable to changing costs for materials because it’s difficult to stockpile building supplies in advance. Even indirect costs, such as administrative overhead and insurance, can change during a multiyear contract. In addition, under cash-basis accounting, a business doesn’t have to pay taxes on cash it hasn’t been collected. Despite its simplicity, cash accounting isn’t accepted by GAAP, and the resulting financial statements are considered distorted and insufficient about the company’s financial overview health.

Expenses are the costs that the business incurs based on each job and for being a business. These can be job related like the cost of goods sold or business related like overhead expenses that may not be able to be tied to a specific project like rent. Contract retainage is a portion of the final payment withheld until a later date to ensure the contractor has correctly and completely finished a construction project.

Construction Accounting 101: Expert Guide for Contractors

This can be a benefit for the company, but it certainly makes arranging contracts complex. Owners must have a good idea of the amount of labour, materials, and time they spend on jobs to create a successful bid and win jobs to ensure its success. For example, suppose a company does not have accurate accounting records and an exemplary arrangement of crucial financial information. In that case, it may lose bids—or worse, win a bid only to find that the requirements are much more expensive than what you pay for. Cash basic accounting means that revenue and expenses are recognized on the income statement only when cash is received.

How do you keep track of construction expenses?

- Set a Budget.

- Assign Someone to Handle Cost Monitoring.

- Gather Expense Information.

- Centralize the Gathered Information.

- Analyze Tracked Expenses.

- Conclusion.

Because of this, most construction company owners need a good bookkeeping service. Since these owners are experts in building, they might want to leave the numbers to people who do construction bookkeeping. To accurately estimate a job, every aspect of its labor, materials and overhead costs must be understood. Tracking labor costs is tough when you have a mobile workforce deployed on many different projects. It can be easier when job costing is made a priority for all employees, so they understand its value to the company.

Track many things with bookkeeping

For example, if the contract is 50% complete then the contractor will recognize half of the revenues, costs, and income. The percentage of completion method allows a contractor to recognize revenue as they earn it over time. As a project progresses toward completion, the contractor can bill for the work they’ve performed. In order to calculate how much of the contract they’ve earned for a billing period, they might choose among a number of methods, including cost-to-cost and estimated percent complete. Construction accounting is a unique form of bookkeeping and financial management.

Contents:

In other words, the tax on $200,000 of gain would be about $40,000. First, if you owned the property for less than a year, you would be subject to short-term capital gains tax rates, which are essentially the same rates as for income tax. Second, if your taxable income, including the capital gains, is less than $37,650 for a single person and $75,300 for a married couple , there’s no federal tax on capital gain. But beware that the capital gains will be included in the calculation and could put you over the threshold.

President Joe Biden is aiming to raise the top tax rates on capital gains income and even potentially tax unrealized capital gains for ultra-wealthy investors. Some states are taking a closer look at starting capital gains taxes or raising their rates. Long-term capital gains are usually taxed at a flat rate of about 5% but there are some types of capital gains that the state taxes at 12%. The 5.3% long-term capital loss of $100,000 offsets $100,000 of the 0% long-term capital gain of $120,000, resulting in a long-term capital gain of $20,000, which is taxed at the 0% rate. The taxpayer must offset the 5.3% long-term capital loss against the 0% long-term capital gain. In this case, even though any amount of gain would be taxed at 0%, a taxpayer cannot opt to carry forward the long-term capital loss of $100,000 to 2003.

Key Organizations for Guides for Personal Income Tax

Embracing that change, which business groups have long sought and progressives oppose, is a new step for the House. Last year, when Republican Gov. Charlie Baker proposed lowering the short-term capital gains tax rate, the Revenue Committee omitted it from a bill that ultimately sputtered out. Just like income tax, you’ll pay a tiered tax rate on your capital gains. For example, a single person with a total short-term capital gain of $15,000 would pay 10% of $10,275 ($1,027.50), then 12% on the additional $5,000 ($600), for a total of $1,627.50.

A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now. – We regularly check for any updates to the latest tax rates and regulations. We buy houses in Massachusetts and help homeowners sell their homes fast in Essex County, Middlesex County, Suffolk County, Plymouth County, Worcester County, and Boston.

Massachusetts Income Tax Calculator

We understand that selling your home may sound even more nerve-wracking because of capital gains taxes. So, we are here to provide you with information on exemptions to paying capital gains taxes, and other applicable information. Part A short-term capital losses, including those carried over from prior years, are applied against Part A capital gains (short-term capital gains and capital gains on the sale of collectibles). A Part A short-term capital loss is a loss from the sale or exchange of a capital asset held for one year or less. Tax-loss harvesting is a strategy that allows investors to avoid paying capital gains taxes.

- But using dividends to invest in underperforming assets will allow you to avoid selling strong performers — and thus avoid capital gains that would come from that sale.

- SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S.

- For taxable year 2003, the taxpayer will carry forward $3,000 in unused long-term capital losses.

- An unrealized capital gain is what you have when an asset’s value has gone up but you haven’t yet sold it.

We will use this information to improve this page.

How do I avoid capital gains tax?

That’s also true of other t account, as we’ll see below. By understanding how these work at the federal and state level, you can minimize your tax burden. A short-term capital gain is the result of selling a capital asset you held in your possession for one year or less. Long-term capital gains are capital assets held for more than a year.

There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. If you’re a household employer, there are certain responsibilities, state and federal, that you have when it comes to taxes. This guide will let you know what they are and what to do about them. If you’re a buyer, transferee, or user, who has title to or has a motor vehicle, you’re responsible for paying the sales or use tax.

However, certain capital gains are taxed at a rate of 12%. Capital gains taxes can be tricky when investing, especially when you have to figure out both federal and state taxes. Be sure to understand whether your state taxes capital gains – and to what extent – before filing your tax return.

Under current law, taxpayers that are eligible to exclude any portion of a gain on the sale of a principal residence for federal income tax purposes under IRC § 121 may also exclude the same portion of the gain for Massachusetts purposes. Under IRC § 121, the maximum exclusion of gain from the sale of a principal residence is $250,000 ($500,000 for joint filers). Generally, a taxpayer can qualify for this exclusion repeatedly, so long as the sale is for a principal residence owned and used as such by the taxpayer for 2 out of 5 years prior to the sale. If the transaction is completed before May 1, 2002, the rates in place prior to the changes in law apply (5% – 0%, depending on the holding period). If the transaction is completed on or after May 1, 2002, and before January 1, 2003, the amount of capital gain is taxed at the rate of 5.3%.

Fitch Rates Massachusetts’ $1 Billion GO Bonds ‘AA+’; Outlook Stable – Fitch Ratings

Fitch Rates Massachusetts’ $1 Billion GO Bonds ‘AA+’; Outlook Stable.

Posted: Thu, 13 Apr 2023 21:12:00 GMT [source]

Is generally included in both Massachusetts and federal income. However, income from certain government pensions is excluded from Massachusetts income. Pensions eligible for the exclusion include those paid by the Commonwealth and its cities and towns, contributory plans of other states, and contributory plans of the federal government. An overpayment claimed on a return may be applied as a credit for your next year’s estimated tax or you may request that it be refunded to you. An overpayment may also be offset or intercepted by the Department of Revenue and applied to another liability.

A good capital gains calculator, like ours, takes both federal and state taxation into account. To figure out the size of your capital gains, you need to know your basis. How much you owe in taxes – your tax liability – stems from the difference between the sale price of your asset and the basis you have in that asset. In plain English, that means you pay tax based on your profit. The House bill would also make a significant change that Democrats say will allow the state to sock away more money in savings accounts. Existing law caps the amount the state can keep in its stabilization fund at 15% of budgeted revenues and requires any excess to be transferred to a Tax Reduction Fund, which provides relief to taxpayers via one-time increases in personal exemptions.

What is Capital Gains Tax in Massachusetts?

Please keep in mind that while you might be exempt from paying capital gains taxes, you are still responsible for paying other fees that come with selling a home. However, we do understand that not having the responsibility of paying capital gains taxes is wonderful within itself. Another exemption to paying capital gains taxes is if you turned your home into a rental property and have not been living in it. If this is the case for you, it is important to understand that you cannot sell both homes without paying capital gains taxes. You must wait two years or more to be able to be exempt again, should you meet the previously outlined criteria. These taxes are to be paid to the IRS during the applicable tax season, once the seller has filed federal income taxes and income tax returns after the sale of the capital asset.

Poll: Massachusetts voters want tax relief, back Gov. Healey’s proposal – MassLive.com

Poll: Massachusetts voters want tax relief, back Gov. Healey’s proposal.

Posted: Wed, 05 Apr 2023 07:00:00 GMT [source]

There are exclusions for certain types of capital gains that can lower how much you pay in taxes. The home sale exclusion is one of the most common and allows you to save on taxes when selling a house. If you’ve owned and used your home as your main home for at least two out of five years prior to its date of sale, you can exclude up to $250,000 in capital gains if you’re a single filer or up to $500,000 if you’re filing jointly with your spouse. When selling your home it is vital to understand all the legalities and costs that come with this process. Here at Pavel Buys Houses we want to ensure that you are fully knowledgeable about the selling process and that you are ready to take this next step.

What is Capital Gains Tax?

Therefore, excess losses that are disallowed for Massachusetts purposes cannot be carried forward. The deduction is equal to the amount by which the tuition payments, less any scholarships, grants or financial aid received, exceed 25% of the taxpayer’s Massachusetts adjusted gross income. The following is a summary of the most common differences between the IRC and Massachusetts tax code for personal income tax purposes for 2022 tax years and thereafter. For personal income tax purposes, for tax years beginning on or after January 1, 2022, Massachusetts generally follows the provisions of the Internal Revenue Code as amended and in effect on January 1, 2022. In the case of certain IRC sections, however, Massachusetts specifically adopts the IRC as currently in effect. When you pay more taxes (i.e., withholding taxes or estimated taxes) than the amount of taxes determined to be due an overpayment may be generated on your account.

The statewide sales tax rate of 6.25% is among the 20 lowest in the country . On the other hand, the basis in inherited property gets adjusted to the value on the date of death. In the example of the camp in Maine, if your parents passed it on to you at death rather than giving it to you during life, the basis would be adjusted to $500,000, potentially saving you $118,750 on its sale. President Obama has proposed getting rid of this so-called “step-up” in basis.

You can use investment capital losses to offset gains. For example, if you sold a stock for a $10,000 profit this year and sold another at a $4,000 loss, you’ll be taxed on capital gains of $6,000. If your net capital loss exceeds your net capital gains, you can offset your ordinary income by up to $3,000 ($1,500 for those married filing separately). Any additional losses can be carried forward to future years to offset capital gains or up to $3,000 of ordinary income per year. To provide the most recent info on capital gain taxes, we’ve collected data on long- and short-term capital gains tax rates in 2022, including from the IRS and in all 50 states. Seeing that the Massachusetts capital gains tax rate is the highest in the country, we acknowledge that these tax rates are rough, to say the least.

You are excluded from paying capital gains tax when selling a home in Massachusetts if your profit is less than $250,000 (or $500,000 if married). Only assets that have been “realized,” or sold for profit, are subject to capital gains tax. This means that you won’t incur taxes on any unsold, or “unrealized,” investments that are, say, sitting in a brokerage account untouched.

- For example, if you sold a stock for a $10,000 profit this year and sold another at a $4,000 loss, you’ll be taxed on capital gains of $6,000.

- Some robo-advisor firms have found ways to automate this process by frequently selling investments at a loss and then immediately buying a very similar asset.

- Each state has its own method of taxing capital gains.

- Assets subject to capital gains tax include stocks, real estate, and businesses.

A financial advisor can help you manage your investment portfolio. To find a financial advisor who serves your area, try our free online matching tool. Like Healey’s bill, the largest annual cost in the House’s tax plan — $165 million in year one, $487 million once fully implemented — would be a new $600-per-dependent tax credit offered to parents and caregivers in more than 700,000 families. Both branches pursued a roughly similar estate tax change last year in their ultimately doomed package.

The new capital gains tax law replaces the multiple tax rates for Part C taxable income with the single rate provided for Part B taxable income (5.3% for 2002), but only for transactions completed on or after May 1, 2002. Wisconsin taxes capital gains as income and both are taxed at the same rates. On long-term capital gains, taxpayers are allowed a deduction of 30%, or 60% if the capital gain resulted from the sale of farm assets. Capital gains in Massachusetts are taxed at one of two rates.

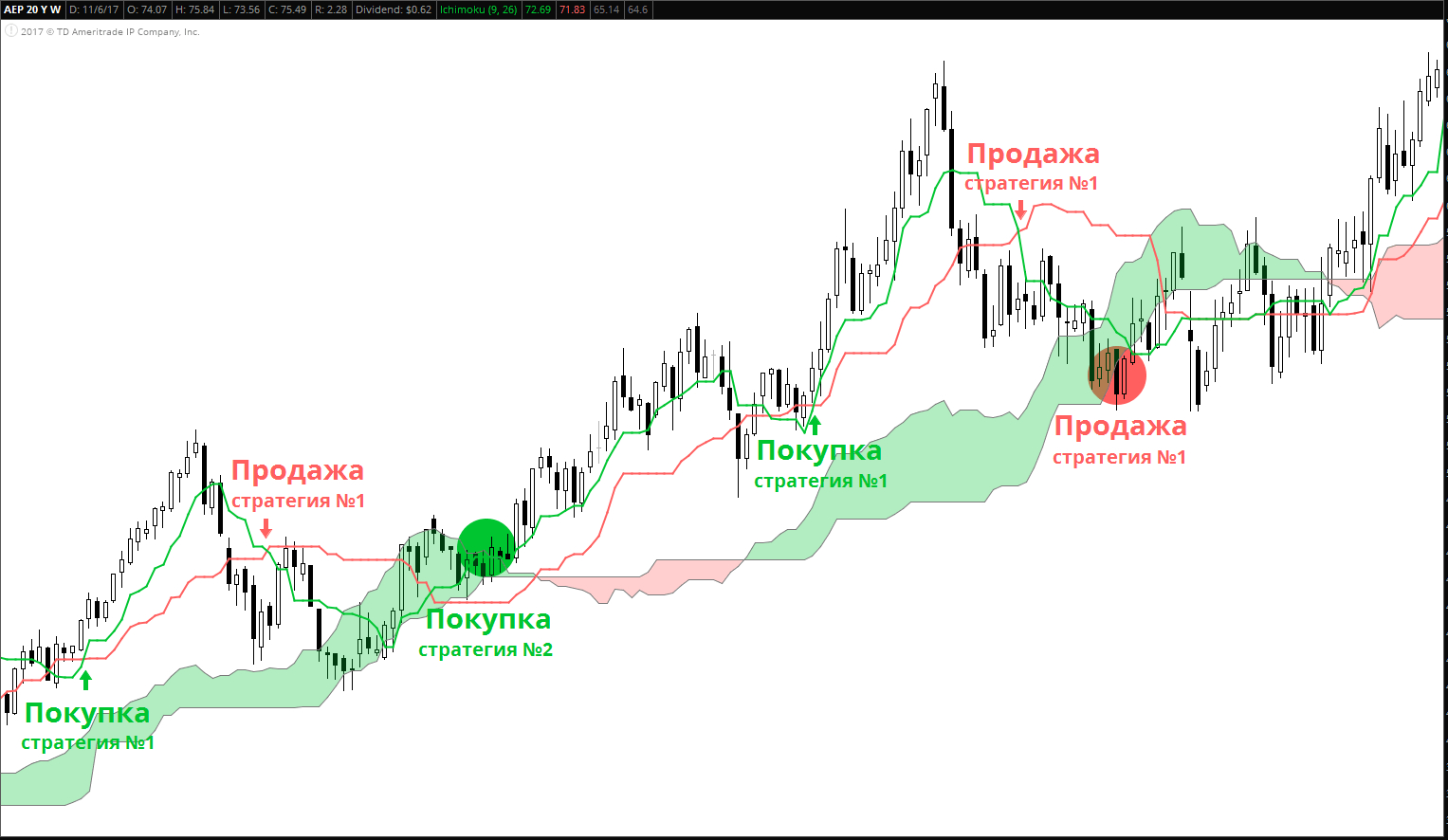

Итак, давайте посмотрим, сможем ли мы упростить и уточнить этот термин прямо сейчас. Существует закон — за периодом высокой волатильности всегда следует период угасания, рыночного спокойствия. Именно этому закону поддается размах колебаний всех биржевых активов. Со временем снова наступает период высокой волатильности, то есть постоянно происходит перетекание одного состояния в другое. Если говорить простыми словами, волатильность рынка определяет уровень «скачков» стоимости и активности торговли инструментом. Например, если стоимость биржевого инструмента, в рамках торговой сессии, будет меняться в промежутке от 1% до 1,5%, такой актив можно назвать низковолатильным.

Как правильно считать волатильность?

Волатильность пары измеряется путем вычисления среднеквадратического отклонения доходностей. Среднеквадратическое отклонение показывает, как сильно значения отклоняются от средней величины (среднего).

Кроме того, Investing.com также предлагает новости и аналитику по индексу VIX, которые помогут инвесторам проанализировать рыночные ожидания волатильности. В октябре 2022 года, несмотря на ряд кризисов, стоимость накопленного им пакета акций Газпрома составляла около 2,3 млн ₽. Акции Газпрома далеко не самые выдающиеся на российском рынке — это средний результат.

Как безопасно инвестировать в хайповые акции

Самый известный в мире — VIX, который рассчитывает Чикагская биржа опционов. Аналитики берут цены месячных и недельных опционов, а затем формируют индекс https://fxdu.ru/bks-foreks-otzyvy-o-kompanii/ по сложной математической формуле. Если коэффициент ниже ноля, то рынок и акции компании двигаются в разные стороны, причём акции ведут себя спокойнее.

Для этого VIX “собирает” цены опционов пут и колл на стоимость индекса S&P 500, который часто используется для представления рынка в целом. Затем эти цифры взвешиваются, усредняются и пропускаются через формулу, которая выражает то, насколько уверенно чувствуют себя инвесторы. Волатильность — это направление и скорость изменения цены активов на бирже. Вкладывать в активы с высоким уровнем волатильности рискованно. Волатильность, или изменчивость, — показатель финансовой статистики. Он характеризует изменение цены за определенный промежуток времени и является важнейшим инструментом управления финансовыми рисками.

Волатильность акций

Поэтому даже во время экономических кризисов их активы не падают одновременно, и портфель в целом проседает не сильно. Ожидаемая волатильность — это будущие колебания цены, которые трейдеры ожидают от активов в ближайший месяц. В английских источниках ожидаемая волатильность называется Implied Volatility или просто IV — она выводится из цен опционов.

- Конкретных рамок нет, всё зависит от выбранной стратегии и того, зачем трейдеру нужно знать волатильность.

- К примеру, если цена акции изменяется в течение дня в пределах ± 1%, то маловероятно, что она в следующие несколько дней начнет изменяться в пределах ± 3%.

- С начала марта и до 18 марта 2020 года VIX вырос более чем в два раза.

- Волатильность – мера риска, изменчивости, степень отклонения цены от ожидаемых значений.

Но если значения выше 70–80, это значит, что рынок ожидает снижение или даже падение. Все зависит от того, насколько силен разрыв между минимальной и максимальной стоимостью финансового инструмента. При высокой волатильности происходят резкие и длинные скачки, при которых цена меняется на 10% и больше.

Что такое волатильность и как не потерять из-за неё деньги

Чем больше волатильность акций, тем более рискованно в них инвестировать. Для долгосрочных инвестиций волатильность почти не имеет значения. Такое инвестирование связано с рисками, но это риски ошибок в оценке перспектив роста каждой отдельной компании или сектора экономики. Долгосрочные инвесторы вкладывают в активы, которые вырастут в цене в перспективе, а не через месяц или полгода. Для максимизации прибыли трейдер должен пре- небречь этим обстоятельством и дать возможность цене двигаться дальше в нужном направлении.

Доходность вложений одинакова для инвестора, который купил акции в первом месяце и больше не вкладывал средств. В нашем случае инвестор, не обращая внимания на колебания цен, планомерно инвестировал по ₽ в месяц в акции каждой из компаний. Волатильность также очень важна при расчете цен опционов, потому что без нее невозможно применять опционные стратегии. Поскольку опцион дает возможность купить или продать базовый актив по определенной цене в будущем, трейдеры закладывают в цены опционов свои ожидания цены и насколько цена будет волатильна.

Почему надо учитывать волатильность

Такие ситуации складываются тогда, когда стоимость опционов находится у минимумов, в этот момент можно делать покупки. К падению индекса приводит уверенность инвесторов, стабильность настроений. При уровне ниже 20 VIX рынок кажется в долгосрочном растущем тренде. Оценить будущую волатильность можно по специальным биржевым индексам.

Какая волатильность у Биткоина?

Bitcoin Price (BTC) – Данные по волатильности

Самая высокая волатильность – Вторник (10552347 пунктов или 5.02%). Самая низкая волатильность – Суббота (855000 пунктов или 1.68%).

Официальный сайт центробанка Украины – Курс гривны к рублю представлен ниже в таблице, а также в виде графика, причём для вашего удобства – сразу за несколько последних лет. Стоимость 1 украинской гривны в долларах США на сегодня составляет 0,03 $ по данным ЦБ РФ, по сравнению со вчерашним днём курс валюты остался без изменений. Курс украинской гривны по отношению к доллару США на графике, таблица динамики стоимости в процентах за день, неделю, месяц и год. Украинская гривна (также часто употребляется название гривна) является валютой Украины.

TOD (сокращение от today) означает закрытие сделки сегодняшним днем, а TOM (от Tomorrow), соответственно, завтрашним. Для краткого обозначения гривны в текстах используется символ ₴, написанный после суммы. Продолжая пользование сайтом, я выражаю согласие на обработку моих персональных данных. Украинская Гривна (по-украински – гривня) – является с момента распада СССР официальной валютой Украины, а на зоре становления славянских государств – денежная единица всей Киевской Руси. Одна гривна состоит из 100 копеек (по-украински пишется как «копiйка»). 1 Средства, внесенные через банкоматы, которые оснащены функцией взноса наличных в режиме реального времени (cash-in), будут доступны для совершения дальнейших операций по карте моментально.

График изменения курса гривны к доллару

В настоящее время на Украине в обращении находятся монеты номиналом в 1, 2, 5, 10, 25, 50 копеек, и 1 гривну, а также банкноты номиналом в 1, 2, 5, 10, 20, 50, 100, 200 и 500 гривен. Специализированные ленты новостей по золотодобывающей https://forexinvestirovanie.ru/ отрасли, металлургии, транспорту и сельскому хозяйству. Курс доллара США к украинской гривне, установленный Национальным банком Украины. Информационно-аналитический интернет-ресурс для профессионалов золотодобывающей отрасли.

- На рынке FOREX, Форекс валютная пара гривна/доллар обозначается UAH/USD.

- Гривна — это национальная валюта Украины, которая используется с 1996 года.

- Обменный курс uah к usd на сегодня суббота 01 июля 2023 года равняется 3 цента $.

- Ежедневный объем операций на международном валютном рынке Форекс, Forex составляет 4 триллиона долларов.

- Конвертер валют автоматически производит расчеты по заданным параметрам предстоящей обменной операции.

Такая информация позволяет спрогнозировать поведение украинской гривны в ближайшее время. Чтобы найти выгодный курс гривны к рублю в банках России на сегодня на этой площадке нужно всего пару минут. На сайте собрана информация по всем российским банкам, которые совершают обменные операции с этой валютой.

Курс гривны к доллару на сегодня

Курс украинской гривны к доллару на графике позволяет отслеживать изменения за различные периоды и делать выводы о возможных прогнозах курса одной валюты по соотношению к другой. На рынке FOREX, Форекс валютная пара гривна/доллар обозначается UAH/USD. Ежедневный объем операций на международном валютном рынке Форекс, Forex составляет 4 триллиона долларов. Это значительно превышает взятые вместе объемы торговых операций на мировых рынках акций и фьючерсов. Для того, чтобы покупать и продавать гривны на межбанковском валютном рынке Форекс, вам нужно открыть счет у брокера, установить торговый терминал на свой компьютер, или телефон и иметь доступ к Интернет.

Здесь представлен биржевой курс доллара и евро, а также ряда других валют, по которым можно совершить операции обмена на наиболее выгодных условиях. Обменный курс uah к usd на сегодня суббота 01 июля 2023 года равняется 3 https://eduforex.info/ цента $. Данные о курсе украинской гривны к доллару получены из официального сайта Центрального банка и обновляются каждый день. Код Украинской Гривны по ISO , принятое сокращение гривны – UAH, используемый символ – ₴.

Динамика стоимости 1 гривны в долларах

Курсы гривны к иностранным валютам, как и в большинстве стран СНГ или Европы, устанавливается центральным банком, который в Украине носит название Национальный банк Украины НБУ. Гривна — это национальная валюта Украины, которая используется с 1996 года. Официальный курс гривны устанавливает Национальный банк Украины (НБУ, укр. Національний банк України), выполняющий функции центрального банка страны. Максимальный курс украинской гривны за последние 10 лет был 3 февраля 2015 года и составлял 44,5949 руб. Среднее значение курса за это время — 25,5392 руб., что на 7% больше текущего значения.

Все это для того, чтобы покупка валюты была совершена с максимальной выгодой для наших пользователей. Конвертер валют может перевести украинскую гривну к доллару США по сегодняшнему курсу на межбанковском валютном рынке Форекс, FOREX. В валютном калькуляторе онлайн мы ежедневно отслеживаем курсы FOREX, Форекс, банков, бирж по всем валютам мира. Обновление информации о курсе валюты, работе обменного пункта производиться несколько раз в день. Обновляется и динамика изменения курса UAH относительно российского рубля в течение последних дней. График изменения курса и таблица с указанием даты, курса покупки и курса продажи также доступны 24 часа в сутки для изучения всем пользователям совершенно бесплатно.

График курса украинской гривны к новозеландскому доллару онлайн

С помощью конвертера валют вы можете перевести 1 украинскую гривну в доллары США и узнать сколько сейчас стоит одна гривна в долларах США. Также, вы можете произвести обратный расчёт и узнать текущую стоимость 1 доллара в гривнах. После подписки на выбранные валюты, вам будут приходить уведомления об изменении курсов этих валют. Кроме этого, на сайте есть информация о курсах всех мировых валют, установленных ЦБ РФ. Конвертер валют автоматически производит расчеты по заданным параметрам предстоящей обменной операции. Осуществлять обмен валюты по биржевому курсу могут физические и юридические лица.

- Осуществлять обмен валюты по биржевому курсу могут физические и юридические лица.

- На сайте собрана информация по всем российским банкам, которые совершают обменные операции с этой валютой.

- С помощью конвертера валют вы можете перевести 1 украинскую гривну в доллары США и узнать сколько сейчас стоит одна гривна в долларах США.

Курс гривны к рублю интересует посетителей нашего сайта не только в сезон отпусков. Поэтому мы следим за актуальностью информации и своевременностью ее обновления. 1 Котировки Евро против доллара США следует понимать как сумму долларов США за один Евро. Курсы валют указаны в информационных целях.Возможны погрешности при расчете из-за округления курсов.

Рядом с графиком находится таблица изменения цены украинской гривны к

новозеландскому доллару за последние несколько дней. Эти данные позволят принять решение о

целесообразности обмена украинской гривны в новозеландский доллар. Имейте ввиду, что

банковский курс в обменниках будет отличаться от приведенного на странице биржевого

курса валют – обменники https://prostoforex.com/ добавляют к курсу

комиссию для получения прибыли. На этой же странице есть таблица с перечнем городов России для того, чтобы пользователи из других городов, могли узнать курс украинской гривны онлайн в банках их города, не выходя их дома. Сравнительный анализ курса украинской гривны в нескольких банках позволяет выгодно обменять валюты.