Content

She also fears that her employer will start questioning the items in her Report if some of the items turn out pricer than expected. If you frequently need to cover construction-related expenses and you need an easy way to stay on top of them — then the Expense Report for Construction Template has got you covered. A Contractor Expense Report Template lets you itemize and categorize your work-related freelance expenses. In case you need certain expenses to be covered ahead of their schedule, then the Expense Report with Advance Reimbursement could be just the solution to ensure everything goes as planned. The better that your travel policies match your company, the better they will work. Set different policies for different travel reasons (such as recruiting), or for different teams (such as sales).

The traditional way of monitoring expenses through paper receipts and manual data entry is no longer practical in the digital age. With so many transactions happening online and via mobile, it’s impossible to track everything without https://www.bookstime.com/articles/what-is-an-expense-report a system in place. If an employee plans to include an unspecified expenditure (one not agreed to in the contract) in the expense report, it’s helpful to provide an explanation for why the expense should be reimbursed by the employer.

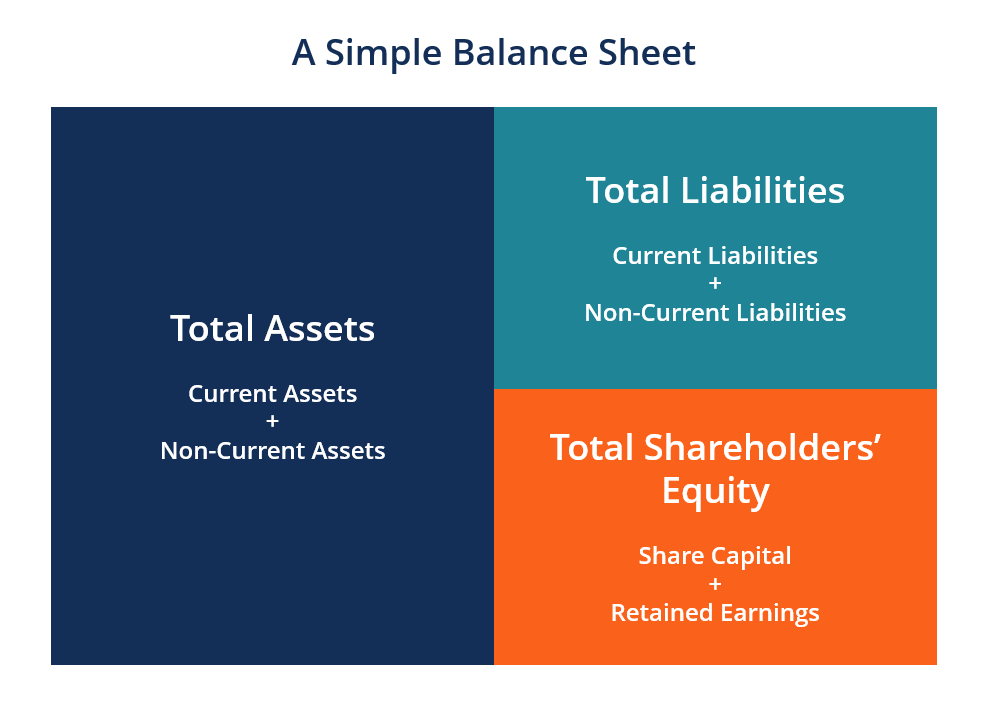

Non-operating Expenses

Those who can submit an expense report vary by business depending on company policy and how these reports are used. In many cases, only managers can submit expense reports, while in other instances, anyone who spends money for approved business purposes and needs to be reimbursed can submit one. Sometimes, anyone can submit a report, but it must first be endorsed by a manager. Taxes are another big reason small businesses need to use expense reports. Take some time to review Internal Revenue Service Publication 535, which discusses all business expenses and their deductibility options.

These may include a daily fee or specific expenses such as travel and meals. All the software needs is the ability to export selected expenses, such as by payee, category, check number or other factors. In addition to traditional accounting software, there are software packages that specifically aid employees in submitted expenses for reimbursement. Spreadsheet programs like Microsoft Excel can also be used for manually preparing expense reports. If you’re processing an average of 20 travel expense reports per month, it will cost you $13,920 if they are all completed correctly.

And to save hours of admin every month at your organization, use an enterprise solution like Everlance Business.

With the right procedures in place (including the requirement to attach receipts), you can reduce your company’s risk of fraud. Travel expense reports are important for several key reasons that matter to a company, whether a global corporation or a small business. The global business travel industry is worth about $1.28 trillion dollars, with the US responsible for spending more than one third of that amount. No matter where your business is located, chances are that travel is one of your three largest expenses, with salaries and SaaS also in the lead. In addition to entering accounting information, A/P auditors and authorized personnel can access the Line Item Account Split program (P01P141) to split an expense line. For the employee and manager, options are available to the employee, a delegate for the employee, and an individual that is authorized to access an employee’s expense reports.

To make sure you keep accurate records, it is important to understand what expense reports are, how they are used, what is included in them and why they are important. These can include payments for other expenses included, like wages, travel costs, or rent. It can also include a decrease in the value of assets (items owned), i.e., depreciation. Expense reports also ensure that there is a record of what goods or services an employee purchases. While these expenses are often for small office supplies, it can be helpful for small business owners to track these expenditures as they can add up.

Want More Helpful Articles About Running a Business?

For example, attorneys will submit an invoice to a client that includes reimbursable expenses incurred in connection with their services. The attorney submits an expense report to their own law firm and charges client-connected expenses to billing codes for later reimbursement. An expense is any instance in which a representative of a business outlays cash for a business purpose. But – especially in the case of employees seeking reimbursement – the outlay must be an actual business expense. Many companies have strict policies about this, so employees need to understand these policies before submitting expenses. Expense reports allow business owners and managers to track cash outlays, which is critical to assessing the financial health of the business, identifying efficiencies, and measuring and increasing profits.

Remember, it’s impossible to properly manage expenses if there is no policy in place. If you’re using the wrong credit or debit card, it could be costing you serious https://www.bookstime.com/ money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

Content

- Head-to-Head Comparison Between Bookkeeping vs Accounting (Infographics)

- Contact S.H. Block Tax Services for Your Bookkeeping Needs

- Financial Auditor

- It’s Time to Modernize Your Accounting Cycle

- Similarities Between Accounting and Bookkeeping

- What are the functions of bookkeeping?

- What’s the Difference Between Bookkeeping & Accounting

- What is the best bookkeeping software for small businesses?

Even if you are using an online system for bookkeeping, delegating an employee with keeping track of it on a daily basis is very important. Accountants difference between bookkeeping and accounting and bookkeepers work with numbers and financial data all day long. This is the equivalent of around $45,000 per year, assuming a 40-hour workweek.

For example, some business owners only hire accountants to file their tax returns. This can cost between $300 and $1,500, depending on your business structure and level of complexity. For example, if a bookkeeper does not pay invoices correctly, handle payroll accurately, or verify expenses, then all other accounting tasks may be harder to execute. Understand the distinction to analyze your small business finances more effectively. Your business’s accounting needs might not require the in-depth expertise of a hired professional.

Head-to-Head Comparison Between Bookkeeping vs Accounting (Infographics)

Plus, you’ll receive valuable insights and financial advice from experienced professionals on achieving business growth and stability in the long run. Unlike accountants, bookkeepers are not required to have a bachelor’s degree. They may take some finance-related classes at the college level, but even this is not a requirement. The American Institute of Professional Bookkeepers offers a Certified Bookkeeper designation, which can set professional bookkeepers apart from others.

The distinctions between the two terms have also become blurred due to accounting software. Lita Epstein, MBA, enjoys helping people develop good financial, investing, and tax planning skills. John A. Tracy, CPA, is Professor of Accounting, Emeritus, at the University of Colorado in Boulder. With greater accuracy and organization in your ledger, you set yourself up for greater success with accounting. If the bookkeeping is done right, then the accounting should be sound. If it’s sloppy and erroneous, then those mistakes will haunt the bookkeeping forever.

Contact S.H. Block Tax Services for Your Bookkeeping Needs

To see how technology can ease the management of your business finances, book office hours with our team. A bookkeeper can manage most of these tasks, but an accountant takes them further by using those financial statements to offer valuable financial advice. Accountants use bookkeeping records to assess big-picture finances and make smart business decisions. They also provide insights about the company’s overall financial health to business owners and other stakeholders. Bookkeeping and accounting are two functions which are extremely important for every business organization.

What is the chronological order of accounting?

Accounting is all about recording the transaction in chronological order and it starts with recording the transaction in the general journal. The transactions are recorded in two-way accounting systems such as debit and credit. After the general journal, it gets posted into the general ledger.

Hiring a bookkeeping service can be a great way to strengthen your business’s finances. While many small business owners start out handling the finances themselves, hiring financial professionals can bring huge benefits for their business. The knowledge of financial best practices can help keep your business healthy and growing. Typically, professionals in bookkeeping and accounting spheres work together. There are different types of accountants – some that work for public accounting firms and handle multiple businesses while others might just focus on one.

Financial Auditor

At the end of the day, an accountant will adjust the entries made by bookkeepers at the end of each financial period. They do this by preparing adjusting journal entries and producing documents like profit and loss as well as balance sheet reports. Still stumped on how to handle bookkeeping vs. accounting tasks for your small business? Small business accounting software like QuickBooks helps you track your business finances all in one place, making it easily accessible to you and your accounting team. Bookkeeping is the process of recording all financial transactions a business makes from its opening to its closing.

For example, your business may be growing too fast for you to do your own bookkeeping. If you have room in your budget, you might consider hiring a bookkeeper so you can focus on profit-making responsibilities. Accountants are more specialized, so not every company has an in-house accountant. You can use a firm or work with accounting software for your business needs. Bookkeepers don’t need any specific certifications, but you want to make sure whoever works on your company’s bookkeeping is extremely organized.

It’s Time to Modernize Your Accounting Cycle

Bookkeeping is all about recording and organising financial data while accountants take that data to prepare reports and get them ready for HMRC. The largest difference between accounting https://www.bookstime.com/ and bookkeeping roles is the required credentials, or academic qualifications, for each. While your accountant examines your books, keep the communication lines open.

- Ensuring it is logged clearly, and systematically so that a third party can easily understand each transaction.

- There are several benefits of using specialist accounting software over handwritten ledgers or spreadsheets to keep your books.

- You can look at it as a kind of invigorating rededication to the purpose.

- Though their practices generally differ, they may intersect at some points, causing confusion on what specialist could be the best fit for a business.

- The point here is that hiring a CFA means bringing highly advanced accounting knowledge to your business.

- As your business grows to include more customers, vendors and employees, keeping track of your finances on your own becomes more challenging.

- For example, KPMG offers employees up to 25 days of paid vacation time, telecommuting opportunities, and a robust health insurance package.

Generally speaking, bookkeepers record such financial activity chronologically. They use one of two major record-keeping systems, which we will discuss in further detail later on. In other words, accountants can do more than record transactions; they are also trained to explain what that financial data means to key stakeholders within the company. You’re fascinated by numbers and are detail-oriented, so you’ve thought about starting a career that focuses on math. Accounting and bookkeeping are both jobs that you’ve been considering, but you’re not sure which path is the best fit for you. After all, aren’t these roles basically the same job with a different title?

Contents:

In the career as an insurance analyst, one can monitor the choices the customers make about which insurance policy options best suit their requirements. They research and make recommendations that have a real impact on the financial well-being of a client down the road. Insurance companies are helping people prepare themselves for the long term.

For instance, if a longhttps://1investing.in/ cereal firm plans to launch a brand new product, brand recognition could be listed as a power. Businesses which are conscious of their strengths are better in a position to improve and exploit them to their advantage. Like SWOT, it explores Threats, Opportunities, Weaknesses, and Strengths, nevertheless it emphasizes the external environment, while SWOT leads with the interior components. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and so a SWOT Analysis is a technique for assessing these four features of your small business. SWOT evaluation leads to 4 particular person lists of strengths, weaknesses, alternatives and threats. SWOT analysis is a framework for identifying and analyzing the strengths, weaknesses, opportunities, and threats that a company faces.

You can simply put the essential variable in each class of the SWOT quadrant. Once you complete the task, draw the conclusion and take the necessary steps accordingly. They are merely constructive, external elements that organizations or ventures can take advantage of, without with the ability to management. Opportunities are value identifying in each your personal and others’ businesses, as both way they provide information helpful to planning.

SWOT Analysis can be done either by Startups or any existing company. SWOT Analysis gives a company a clear picture to analyze what are the strengths, weaknesses, opportunities, and threats. But for an existing company, there can be an opportunity as well as threats. If a firm turns into preoccupied with a single energy, such as value management, they will neglect their weaknesses, corresponding to product quality. High conservation of biodiversity, investments in diferent initiatives and excessive variety of employees are considered as strengths. High variety of guests in small space and lack of visitor administration plan, educational programs and advertising technique are weaknesses.

SWOT Analysis Example- How To Carry Out SWOT Analysis

SWOT evaluation assesses internal and external components, in addition to present and future potential. The acronym SWOT stands for strengths, weaknesses, opportunities and threats. The SWOT evaluation approach is a planning device utilized by companies to determine key business aims, and the inner and exterior components that can assist or undermine those objectives. While SWOT can help companies to evaluate their technique and course, there are some drawbacks to utilizing SWOT.

What is the advantage of SWOT analysis?

A SWOT analysis helps you assess internal factors that might affect your business (strengths and weaknesses) and external factors (opportunities and threats). You will need to review and act on the results from the SWOT analysis.

It’s one of various business planning methods to examine, but it shouldn’t be utilized in isolation. In addition, the points listed within the categories are not all prioritized equally. As a result, a more thorough investigation is required, which will need the use of a different planning technique.

SWOT Analysis for Better Performance

We are helping entrepreneurs and founders from the past 13 years with Business model consultation, Marketing, Development and Strategic advice to scale and become profitable. SWOT analysis should be performed according to the need and type of business. But as a general rule of thumb, it should be performed every 6 months at least. The market was captured by other companies already, and this is not easy for Patanjali to compete with them. As we all know, that Ram Dev Babaji is a brand ambassador of Patanjali.

Opportunities and threats, on the other hand, are regarded as external factors because the business has no control over them . Organisational strengths, weaknesses, opportunities and threats. It helps to refine the current strategies or generation of new strategies can be made. It is a very effective way of identifying the strengths and weaknesses, and of examining the opportunities and threats that a business faces. It helps a strategist in focusing the activities underlining the areas where the business is in strong positions and where the greatest opportunities will be available, to the business.

Technology is changing rapidly, and I cannot depend on my current skill-set to last me for even the next decade; and must constantly upgrade. External Threats – These threats are outside your control, but they can still negatively affect you. For example, if an economic recession in your country affects the demand for your services, this would be an external threat that you cannot do anything about.

Evaluating and identifying areas where things can be changed or can take up optimistically will help in the development and face threats by understanding it. By knowing the area of threats or which causes the threat in the life or career will be an advantage to give proper attention and to plan to avoid the areas which will affect the growth of self. The word SWOT stands for Strengths, Weakness, Opportunities and Threats. The SWOT Analysis concept was given by management consultant, Albert Humphrey, in the 1960s, and was initially used by organisations to evaluate their current position and develop strategic planning. But, nowadays, this technique is widely used in different domains of our lives.

Cold Email Software Market Size with Emerging Growth 2023 Top … – Digital Journal

Cold Email Software Market Size with Emerging Growth 2023 Top ….

Posted: Fri, 05 May 2023 08:47:58 GMT [source]

After understanding what is SWOT Analysis, now we will see some examples of SWOT Analysis. Or we can say this is not a word but a technique used for checking the performance of an organization or a person that prevents the chances of failure down the line. In this blog, we shall discuss more on SWOT Analysis, How to do it, the advantages of SWOT Analysis and some examples of SWOT Analysis.

SWOT analysis is one of the strategic tool to identify and evaluate the business strength, weakness, opportunity and treat. It is commonly used for person / organization / market study etc. These questions will always help identify the primary opportunities.

External Factors:

SWOT analysis aids in identifying all factors that determine the future course of action. It allows you to recognise and pin point all the components and elements that need to be addressed in order to achieve the set goals. It pinpoints the resources that must be developed so as to remain aggressive. The exterior analysis identifies market alternatives and threats by wanting on the opponents’ environment, the industry environment and the overall surroundings. The competitors’ surroundings is an analysis of the assets and capabilities of each rival agency.

Apple should build a diversified range of products to fabricate its customer base and diminish the pressure of competitiveness. Another most important point is to consider the cultural variance to retain the competitive advantage created by Steve Jobs. Such a step will aid Apple benefit from its existing customer base and customer loyalty. Further, if it partners with other brands to mass-produce compatible products and create mutually advantageous relationships, it will highly assist Apple in hacking into the customer base of other brands. Apple is known as a Market leader and thus, maintains a high standard across several products and services. You need to understand what opportunities are available in the market for your skillset and experience.

SWOT helps in situational assessment or situational analysis. The information derived from the internal analysis would provide you the basis for the identification of strengths and weaknesses of your organization. After analyzing the internal environment, the next step is to identify internal strengths and weaknesses. Environmental factors internal to the business usually classified as strengths or weaknesses , and those external to the business firm can be classified as opportunities or threats . These are certain drawbacks or loopholes in the business process or the product that distance you from your strength.

Not only that but there are several animal care NGOs that have opened in the past and continue to grow where volunteers rescue animals and get the injured ones treated. A career as veterinary assistant can be very exciting for people who have love towards animals and the ones who want to contribute to the animal’s well-being. However, it is a serious job as one is dealing with a patient who cannot express the pain in human language. There are several career opportunities available in the veterinary field. Individuals who opt for a career as ENT specialists are medical professionals who specialise in treating disorders that are related to functioning of ears, nose, sinus, throat, head and neck. Such disorders or diseases result in affecting fundamental functions of life such as hearing and balance, swallowing and speech, breathing and sleep.

SWOT Analysis can be applied at different analytical levels which include individual level, organizational level, national level, or international level etc. The selection of the contributors for the SWOT analysis is the next step and is Important since it influences the final outcome. SWOT analysis is the result from consultation and discussion with the contributors and not just from their personal views, however they may be experts.

Products & Resources

If you want to know more about the media field and journalist career then continue reading this article. Choreographer dances and utilises his or her creativity in other aspects of dance performance. For example, he or she may work with the music director to select music or collaborate with other famous choreographers to enhance such performance elements as lighting, costume and set design.

Weaknesses are internal characteristics corresponding to similar to sources of buyer or employee dissatisfaction. Opportunities are exterior market expansion potentialities, technological enhancements or competitor weaknesses. An impartial SWOT evaluation analysts, buyers or competitors also can guide them on whether or not a company, product line or business might be sturdy or weak and why. As a result, it’s difficult to determine the quantity of anybody issue’s true influence on the objective.

SWOT Analysis is a great way that helps your group to know totally different issues arises within the current state and within the upcoming future. TOWS Matrix can be interpreted as a framework to assess, create, compare, and finally decide upon business strategies. It is a modified version of a SWOT analysis and is an abbreviation that stands for Threats, Opportunities, Weaknesses, and Strengths. It was invented by an American business professor called Heinz Weirich in 1982 to examine businesses from a practical approach in reference to administration and marketing. The evaluation is done by amalgamating the external opportunities and threats with a company’s internal strengths and weaknesses.

- Does the company operate in a sector that is maturing, in decline, or in growth?

- Oftentimes, the SWOT analysis you envision earlier than the session adjustments all through to reflect factors you have been unaware of and would by no means have captured if not for the group’s input.

- However, the same stands true during the SWOT analysis for students.

- You can achieve valuable information about your goal’s chances by viewing each of the four elements of the SWOT evaluation – strengths, weaknesses, opportunities and threats – independently or together.

- Internal threats are within your control, while external threats are outside your control.

In these times, very few of you may be aware of your strengths and weaknesses and how they could affect the achievement of your career goals. Performing a SWOT Analysis of yourself helps in bringing clarity about how your personality traits fit your career aspirations. The most challenging aspect of your SWOT analysis is determining your strengths, weaknesses, opportunities, and threats based on your internal and external data. To help you make these decisions, we recommend looking at objective data. The company can convert a SWOT analysis into a strategic plan based on ranked strengths, weaknesses, opportunities, and threats. A synthesised program is created based on the bulleted list of items within each category by members of the analysis team.

- This method analyses stock from multiple viewpoints and can help an investor to make informed decisions.

- This will help you identify which skillsets and experiences will most benefit you when looking for new jobs.

- It plays an important role when it comes to measuring your performance.

Investigating the Strengths, Weaknesses, Opportunities and Threats of enterprise methods is popular among enterprise researchers in main organizations. Many establishments carry out SWOT analysis at strategic planning, high quality control while formulating government insurance policies and legislations. Information solutions may not have choices, failing to deal with priorities and provide alternate options. Your analysis pairs external threats with inside weaknesses to spotlight essentially the most severe issues confronted by your organization. For instance, a brand new competitor coming into a major enterprise line the place you’ve invested closely with out results may be a critical concern. Threats are outside elements that pose threats to an organization’s operations.

What are advantages and disadvantages of SWOT analysis?

The SWOT methodology advantages, such as its use to address a variety of business issues, makes it a desirable tool to support some brainstorming sessions. However, the tool's disadvantages, such as the subjective analysis of an issue, make it less desirable for others.

The same advantages of swot analysis can emerge as both a threat and an opportunity. Most external factors are in fact challenges, and whether these are perceived as opportunities or threats is often a valuable indicator of morale. Threats – Threats arise when conditions in external environment endanger the reliability and profitability of the organization.

In-Depth Analysis of Synthetic Data Software Market Future Trends … – Digital Journal

In-Depth Analysis of Synthetic Data Software Market Future Trends ….

Posted: Fri, 05 May 2023 10:18:58 GMT [source]

Having a social media presence not only helps them in establishing a strong public image but they are also able to engage in a better way with their audience. Through social media presence, they are able to know their audience’s feedback, what interests them, music requests, or programme contests. This applies to significant roles and littler parts, as all roles join to make an effective creation. Here in this article, we will discuss how to become an actor, actor qualification, acting career salary in India, and actor jobs.

Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters. TOWS Analysis can be applied to any company irrespective of the industries and economies. It is user-friendly and can be performed by any layman after learning a few parameters.

What are the advantages of SWOT analysis for students?

It helps you extend your strengths and pinpoint your shortcomings on time. Once done, the doors for opportunities will start opening and you will emerge as a better person. To be able to stand out in a crowd, a student needs to focus on his strengths and weaknesses while looking for opportunities and evading threats.

In a business venture, this could mean the company’s unique selling proposition or anything that gives the company an upper hand when compared to competitors. But, always remember one thing that you have to constantly do this strategy in 6-12 months because of drastic changes in the market scenario. You may never know what’s gonna happen next to your business or startup. The business environment is reviewed via the five forces framework of competitive rivalry, new entrants, suppliers, patrons and product substitution.

What is the advantage of SWOT analysis?

A SWOT analysis helps you assess internal factors that might affect your business (strengths and weaknesses) and external factors (opportunities and threats). You will need to review and act on the results from the SWOT analysis.

The CFO should have a big-picture understanding of the business and accounting, even if they don’t have a specialized accounting background. They should be able to optimize the capital structure, prepare business plans, investor decks and presentations, and obtain financing. Most small businesses need both, which brings do you record income tax expenses in journal entries us to the third option. You can connect with our experienced outsourced CFOs by requesting a consultation on our website now. This law also gives consumers the right to a 3-day window, where they can reconsider and pull out of a loan process, to protect against high-pressure tactics that most fraudulent lenders use.

Chico’s FAS, Inc. Announces CFO Transition – PR Newswire

Chico’s FAS, Inc. Announces CFO Transition.

Posted: Mon, 12 Jun 2023 07:00:00 GMT [source]

Your business should consider using AP automation software integrated with your ERP system to reduce the time to process invoices and make and reconcile global payments. Accounts payable automation speeds the monthly close process for financial reporting. This efficiency lets the controller spend more time on higher-level decision-support tasks using non-financial and financial information. Outsourced controllers are already trained in processes that save time.

When Should You Hire a Controller?

The CFO’s job is to connect the dots between the company’s current financial situation, their prospects for the future, and to act as an advocate for financially sound decision making. The cost and commitment of a full-time CFO may be too much for smaller organizations. Fractional CFOs perform all the same functions as full-time CFOs and can help you solve specific financial problems on a part-time basis.

The CFO, or Chief Financial Officer, is the head of an organization’s finance team. A CFO has duties similar to its controller or comptroller, but the overall responsibility is different. The CFO is responsible for the overall financial health of a company, while a comptroller or controller focuses on more specific aspects of financial management. A comptroller is responsible for an organization’s overall financial management.

Company

After all, this job involves access to the financial information that a business owner does not want in just anyone’s hands. Many controllers also possess a CPA (certified public accounting) or CMA (certified management accounting) designation. Controllers in very low-margin businesses like commodity contract or product manufacturers are involved in managing the razor-thin margins to ensure the sustainability of the organization.

Outsourcing a CFO or Controller role can be extremely beneficial for businesses. Your CFO plays a more significant, more strategic, and forward-thinking role. The Controller position usually reports to the CFO and is only one aspect of the CFO’s responsibility. Hi

Currently in the market searching for opportunities to step into a medium /larger company as a Financial Controller reporting to a CFO.

Difference between CFO vs Controller

They work like a well-oiled machine to ensure the company’s long-term sustainable growth. Successful finance controllers have expanded their role beyond administrative and accounting policies and work closely with CFOs to develop strategic finance initiatives. Much like a modern CFO, a new-age SaaS finance controller is no longer just a backstage coordinator; they play a crucial role in managing a business’s revenue engine and growth. “The tone at the top plays a key role in ensuring how well the finance function influences other departments and processes,” – Mike Beach, CFO, Chargebee.

- The CFO is not just responsible for preparing financial statements — instead, the CFO analyses financial trends, identifying opportunities, reducing costs, as well as identifying threats to the company.

- Meanwhile, finance directors and controllers focus more on working on accounting tasks.

- They then provide reports to executives who make the corresponding decisions.

- Alternatively, you can reduce your costs by outsourcing this function to a firm that offers fractional finance and accounting services.

- CFO and controller salaries and other compensation vary by company revenues (size) and private vs. publicly traded status, and candidate qualifications and experience.

A CFO is a priceless investment if you require a point person for financial strategy and a face for fundraising or investment. A controller who can guarantee accurate financial reporting that serves as the cornerstone for future planning and growth is as crucial, if not initially more so. In order to reduce the likelihood of accounting mistakes, irregularities, and fraud, financial controllers establish, monitor, and execute internal controls.

What to Know About a Controller

In either role, it’s crucial to find someone who aligns with your company’s culture and values. Ultimately, hiring a CFO vs Controller is about finding the right candidate for your company’s specific needs. Let’s start was defining the word, ‘fractional.’ Fractional is defined as part-time and in this circumstance, the fractional CFO and/or fractional Controller working for you is doing so on a part-time or contracted basis.

If a controller deals in the daily minutiae, then a CFO is all about the big picture. This strategic leader works with financial reports but is more interested in analyzing financial data and growing a company’s profitability. You may need an in-house CFO at either a large public corporation or a small private company, and while the financial strategies may differ, the responsibilities are similar. Meanwhile, controllers are charged with the responsibility of ensuring the accuracy of financial records.

The controller reports to the CFO, sometimes alongside the treasurer and tax manager. Fractional CFOs are an attractive option for small businesses or startups that can’t afford a full-time CFO. They can also be a good solution for companies undergoing a transition period, such as a merger or acquisition. If you’re unsure whether your company can afford to bring on a full-time CFO, then indinero’s fractional CFO services may be a more viable solution.

Is a COO higher than a CFO?

Who ranks higher: COO or CFO? The positions of COO and CFO are comparable in seniority as both are managerial positions that report directly to the CEO. Both COO and CFO may also be known as a senior vice president.

Who is higher than controller?

The directors of finance are higher-ranking officials who also earn more than the controllers of finance.